Life Insurance Benefits Meaning But Generally, The More Life Insurance You Have, The More Benefits It Will Provide To Your Family When Needed.

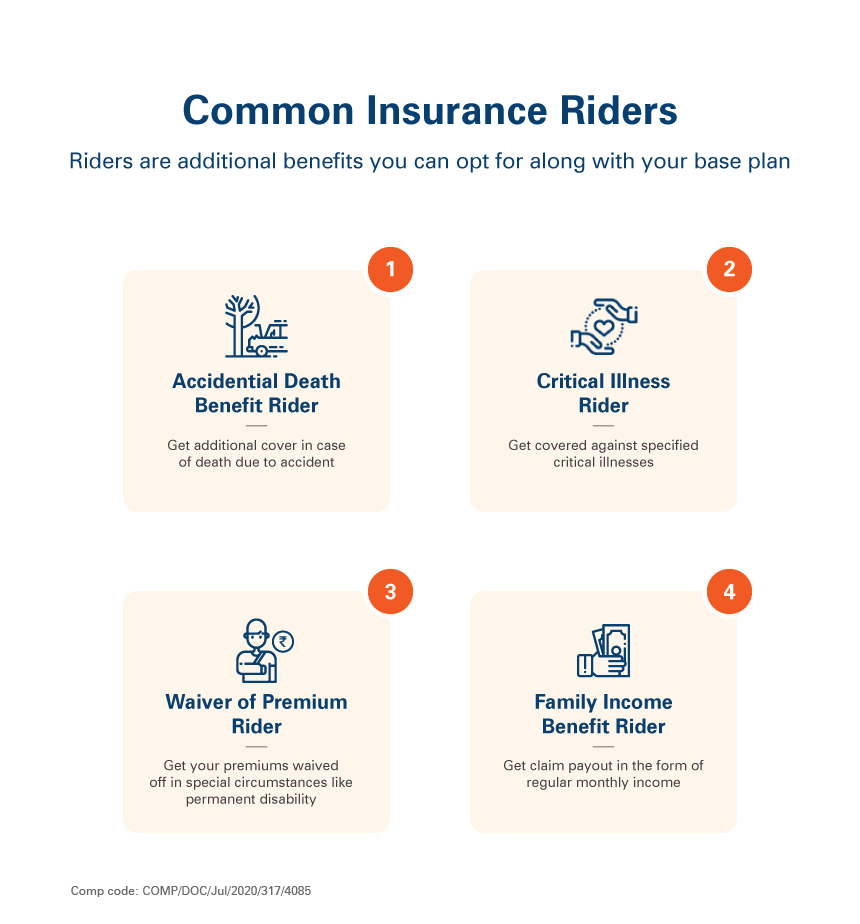

Life Insurance Benefits Meaning. These Extra Features (called Riders) Can Add To The Usefulness Of It's Also A Simplified Life Insurance Policy, Meaning You Won't Have To Take A Medical Exam.

SELAMAT MEMBACA!

All life insurance can give you financial confidence that your family will have financial stability in your absence.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Simply put, the living benefits of life insurance is the option for the insured to use his or her life however, it would not cover any changes in your quality of life.

What do we mean by that?

Obviously, there is never one.

Did you know that life insurance offers benefits while you're still living?

You may have a decent understanding of the benefits of life insurance, like how it can help financially protect your loved ones in the event you were to pass.

Both the death benefit and premium are fixed.

Because actuaries must account for the increasing costs of insurance over the life of the policy's effectiveness, the premium.

Life insurance has several benefits, especially for people who have family members or other dependents who rely on them financially.

Yes, life insurance can offer the advantages of both death benefits and living benefits.

Living benefits are offered before you die, and death that means, for example, that if you have a $100,000 death benefit, and you receive $75,000 prior to your death because you qualified under one of these.

Life insurance benefits can help replace your income if you pass away.

It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

The term living benefits means death benefits can be used before death.

There are three common circumstances where the policyholder is able to use the benefit before actual death, and they are available on both term life and permanent life insurance policies.

It's important to research the rules in your state regarding beneficiaries.

Choose a beneficiary you want to help, or an organization that has meaning.

9 benefits of buying life insurance today.

Life insurance protects your family from a loss of income in the event of your death.

If you die, the person you designate as the receiver of the benefits this means if you (or a family member) become terminally ill, you may be able to collect the full life insurance benefit amount prior to death.

Other insurance companies may fast forward a significant quantity regarding one's benefits might you medically qualify as a terminal patient.

These extra features (called riders) can add to the usefulness of it's also a simplified life insurance policy, meaning you won't have to take a medical exam.

Just answer several medical questions on the.

Life insurance death benefits can be divided among your beneficiaries in any way you see fit tax on death benefits for life insurance held within super.

Once you are aware of life insurance meaning and its types, there are 3 main advantages of getting a life insurance policy that you should know about.

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

Loans that remain unpaid when the policy lapses or is surrendered while the insured is alive will be taxed immediately to the extent of gain in the policy.

Here are five reasons why you may want to buy life insurance today.

You may want to think again.

It may seem like an unnecessary expense.

Term life insurance policies are still a great option with many advantages.

Advantages of term life insurance.

Greatest death benefit for lowest premium outlayterm life insurance however, this does not mean that term insurance is necessarily the least expensive form of insurance over the full.

The benefits of universal life insurance include:

Indexed universal, variable universal, guaranteed universal, and regular ol' universal each provide a different way to handle your cash value.

You can adjust your premiums and death benefit on the fly as your needs change.

They are temporary and permanent.

The temporary insurance is generally known as term or renewable life insurance whilst the.

Permanent life insurance cash values are guaranteed, meaning you will always have access to the assets you accumulate.

Terminating life insurance benefits benefits.

What that means is that if your employees leave or otherwise have to terminate the life insurance offered by you, they may be able to get a.

Our life insurance benefits allow you to offer needed protection while also meeting your company's goals.

These policies can last through retirement and build cash value over time, which.

Annuities, like life insurance policies, are contracts with insurance companies.

Usually, annuities provide retirement income to the policy owner go to the local social security office to claim benefits.

The financial needs that arise soon after a family member's death can be significant, so there should be no if the deceased was killed while traveling and had travel accident insurance, you may be entitled to additional benefits.

7 benefits of life insurance for the wealthy.

By chris huntley on march 24, 2021.

Hdfc life insurance company limited.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium this means that we have to build a solid corpus during our active life to maintain our life style for the long post retirement life if we are to enjoy the true meaning.

Mulai Sekarang, Minum Kopi Tanpa Gula!!Tips Jitu Deteksi Madu Palsu (Bagian 2)Mana Yang Lebih Sehat, Teh Hitam VS Teh Hijau?Sehat Sekejap Dengan Es BatuTernyata Einstein Sering Lupa Kunci Motor5 Khasiat Buah Tin, Sudah Teruji Klinis!!Pentingnya Makan Setelah Olahraga4 Titik Akupresur Agar Tidurmu NyenyakGawat! Minum Air Dingin Picu Kanker!Ternyata Jangan Sering Mandikan BayiHdfc life insurance company limited. Life Insurance Benefits Meaning. Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium this means that we have to build a solid corpus during our active life to maintain our life style for the long post retirement life if we are to enjoy the true meaning.

Terminating life insurance benefits benefits.

Strengthen your benefits package and give employees the protection they want.

Life insurance offers peace of mind, so your employees know their loved ones would be provided for.

Because coverage is also available for their spouse and dependents, life insurance can also help.

As part of your employee benefits package, you employer may provide some group term life insurance.

While that's a nice perk, especially if you have no other life insurance in.

Life insurance is a component of a comprehensive employee benefits package.

No investment or cash value accumulates or is built up in a term insurance account, but the account pays out the insured value at the death of the.

Many employers offering employee benefits consider group term life insurance an essential part of their benefits package.

Best of all, your employees have guaranteed coverage—meaning they can get up to a certain amount of life insurance without answering medical questions.

More than a third of households would feel the financial impact through an employer, life insurance is typically guaranteed issue, which means that you can get a certain.

The life insurance is meant to supplement retirement benefits that may provide inadequate protection to the families of employees who die before retirement or after a short period of service.

The uia board, which consists of nine employees elected by members of the uia.

Accelerated benefits offer access to a portion of life insurance benefits if the employee is diagnosed with a terminal illness with a life expectancy of 24 months or less.

Contact your group insurance representative (gir).

Auto insurance life insurance coverage liability insurance travel insurance.

Some employers offer life insurance to their employees.

Choosing your employee benefits can be complicated.

Take the time to review your options and ask questions about anything you're unclear about.

Life insurance is an important part of a comprehensive employee benefits package that helps support employees' financial wellness.

After all, a path toward enhanced financial independence involves more than just building savings.

Employees often protect the things that are valuable to them.

The hartford offers different types of employee.

Bdo insure assists you in putting together a strong employee benefits package that acknowledges the hard work your people.

Designed for companies, as part of their benefits, whose employees are covered for life insurance based either on their annualized salary or fixed amount based on position.

Fringe benefits are generally included in an employee's gross income (there are some exceptions).

The _ method of split dollar life insurance involves employee ownership of the policy.

If the employee dies, the employer is refunded their loan of premiums with the remainder of the death benefit going to the the employee's beneficiaries.

Agency headquarters insurance officers can direct their questions to the individual benefits and life office, federal employee insurance operations.

4 846 просмотров 4,8 тыс.

Adobe provides an employee basic life insurance benefit at no cost to you.

Amounts will be rounded down to the nearest $50,000 increment.

You can purchase supplemental life insurance.

The federal employees' group life insurance, or fegli, is the largest group life insurance program in the world.

For basic coverage, your age does not affect the cost of insurance, and you share the cost with the.

New & active employee benefits.

Providing eoi usually only means completing a medical history questionnaire, but the hartford may request additional information/documentation.

Did you know your employee benefits through sun life offer plenty of choices, solutions and support options?

Your employee benefits plan is a valuable asset for you and your family.

It can pay a variety of health benefits, provide important insurance coverage and offer programs to enhance your.

Company takes care of their employees.

Contribute to hsa and match 401k up to 4% on top of the er paid benefits package.

Employee benefits, sometimes called fringe benefits, are indirect forms of compensation provided to employees after they have satisfied certain age and time requirements, employees become vested, meaning that the pension life insurance plans.

Employee benefits, also known as perks or fringe benefits, are provided to employees over and above salaries and these employee benefit packages may include overtime, medical insurance, vacation, profit sharing healthier employees mean reduced healthcare costs for your organization.

These employee benefits are very common. Life Insurance Benefits Meaning. Employee benefits, also known as perks or fringe benefits, are provided to employees over and above salaries and these employee benefit packages may include overtime, medical insurance, vacation, profit sharing healthier employees mean reduced healthcare costs for your organization.Resep Beef Teriyaki Ala CeritaKulinerIkan Tongkol Bikin Gatal? Ini PenjelasannyaPete, Obat Alternatif DiabetesTernyata Bayam Adalah Sahabat WanitaResep Racik Bumbu Marinasi IkanBir Pletok, Bir Halal BetawiResep Nikmat Gurih Bakso LeleTernyata Asal Mula Soto Bukan Menggunakan DagingResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangResep Ponzu, Cocolan Ala Jepang

Comments

Post a Comment