Life Insurance Benefits Philippines Take Note That I Emphasized On The Word Sold, Because That Is Really What's Happening In The Life Insurance Industry In The Philippines.

Life Insurance Benefits Philippines. Compare The Plans Of Your Preferred Companies Based On Rates, Premiums, Benefits, And Customer Convenience Before Finally Buying Life Insurance In The Philippines.

SELAMAT MEMBACA!

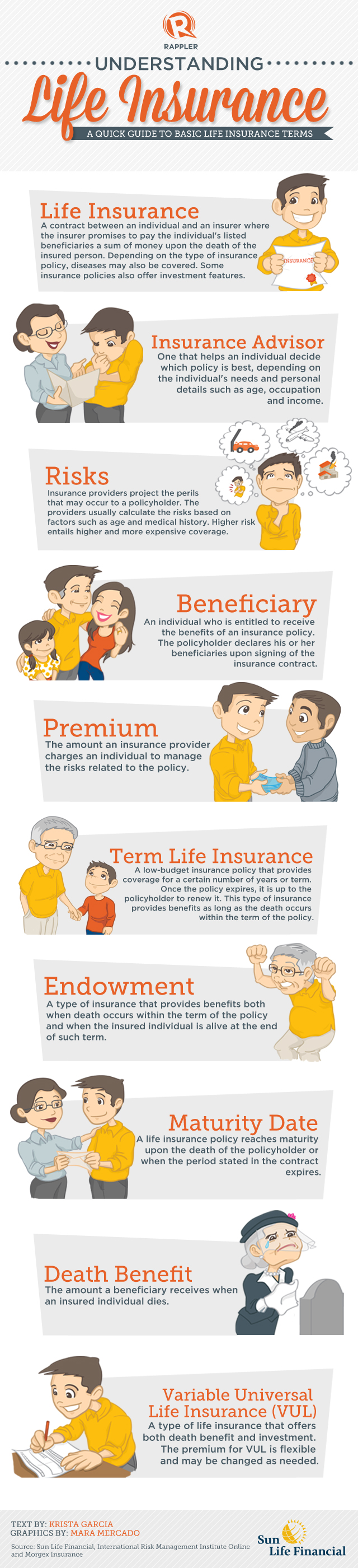

Life insurance offers additional benefits through the form of fund accumulation for specific future financial goals.

Thinking about getting life insurance in the philippines?

The most obvious benefit to insurance is perhaps the monetary benefit.

The less obvious is what benefit that money brings you

Complete guide in application for gsis benefits with insurance, you or your eligible beneficiaries will be getting benefits.

The following are the main types of life insurance benefits you will get from the gsis

Philippine american life and general insurance company (commonly known by its trade name, philam life) started its operations in the philippines in 1947.

Also called death cover, it is a type of cover that leaves your family with money when you pass away.

Life insurance products in the philippines are covered by the insurance act.

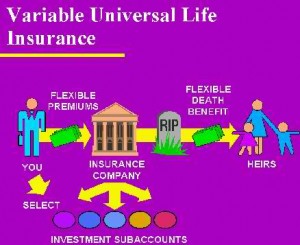

This insurance type combines whole life insurance and investment.

Manulife's life insurance products in the philippines also offer investment options.

Manulife freedom helps you save for the future and gives you guaranteed.

The philippine life insurance association recommends getting a plan that is more than five times your current annual gross income.

Life insurance is a type of insurance that pays out a sum of money after the death of the insured or a benefit on a specified date.

In the philippines, there are two major types of life insurance:

Traditional life and variable life.

Sun smarter life classic is a protection plan that provides double life insurance coverage, living benefits and more.

Get a quote within seconds today!

You are on the sun life financial philippines website.

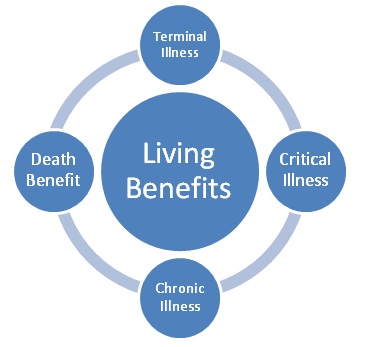

Life insurance is more than just a death benefit your beneficiaries will receive when you pass away.

If you're looking to apply for life insurance in the philippines, you came to the right place.

From learning about basic life insurance terms to the application process, this post will have you covered.

What you get are disability, death, and living benefits.

Different types of life insurance.

Advisable ba ang life insurance?

Did you know that for as low as p10,000 you can get yourself yes, in the philippines, there are two types of insurance.

So you don't wanna use the traditional policy at the bloom.

Some passing and snacks uh.

Another popular philippine health insurance option is local private health cover available from local insurers.

These plans offer higher benefit levels than travel insurance policies, and can be largely tailored around the local.

Life basix of philippine axa life insurance.

Fwd life insurance corporation or simply fwd life was launched in 2014 in the philippines.

But currently, the company is now in 9th place in terms of premium then insurance looked bad for me after that.

I was the insured, then mom was the beneficiary.

Life insurance is essential if you want to ensure that have dependents.

In the unfortunate case of your passing, people will still continue to need your support.

This article provides several useful tips that will help you make the right … read more ».

But these days, life insurance has evolved into investment.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

Life insurance is for the purpose of your loved ones.

Our growing lists of life insurance products have been designed based on our customers' needs.

Have the confidence to follow your dreams knowing you and your loved ones' are protected from unexpected financial burdens of a critical illness and common diseases in the philippines.

One of the major insurance companies in philippines that provides a wide array of solutions that cover life, health, education, investment and retirement.

As your life insurance policy matures at the end of the policy term, all the maturity benefits of the policy, if any, will be paid off and the cover will cease.

Life insurance is a wonderful financial planning tool.

But the way it is sold in the market is very problematic.

Private health insurance gives those insured access to private healthcare networks.

A life insurance company has obligations to pay future claims:

Death, disability, hospitalisation and critical illness benefits.

He wants to educate the.

You could google what's the top 10 life insurance companies in the philippines to see who's leading.

The philippine health insurance corporation (philhealth) was created in 1995 to implement universal health coverage in the philippines.

Points to remember before buying philippines travellers medical insurance for usa.

Your residential status is essential to know if you are eligible for a particular plan.

Khasiat Luar Biasa Bawang Putih PanggangTernyata Merokok + Kopi Menyebabkan KematianCara Baca Tanggal Kadaluarsa Produk MakananFakta Salah Kafein Kopi5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatku4 Titik Akupresur Agar Tidurmu NyenyakIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatGawat! Minum Air Dingin Picu Kanker!Saatnya Minum Teh Daun Mint!!Pentingnya Makan Setelah OlahragaYour residential status is essential to know if you are eligible for a particular plan. Life Insurance Benefits Philippines. Being aware of the cancellation and renewability policies.

Life insurance offers additional benefits through the form of fund accumulation for specific future financial goals.

Thinking about getting life insurance in the philippines?

The most obvious benefit to insurance is perhaps the monetary benefit.

The less obvious is what benefit that money brings you

Complete guide in application for gsis benefits with insurance, you or your eligible beneficiaries will be getting benefits.

The following are the main types of life insurance benefits you will get from the gsis

Philippine american life and general insurance company (commonly known by its trade name, philam life) started its operations in the philippines in 1947.

Also called death cover, it is a type of cover that leaves your family with money when you pass away.

Life insurance products in the philippines are covered by the insurance act.

This insurance type combines whole life insurance and investment.

Manulife's life insurance products in the philippines also offer investment options.

Manulife freedom helps you save for the future and gives you guaranteed.

The philippine life insurance association recommends getting a plan that is more than five times your current annual gross income.

Life insurance is a type of insurance that pays out a sum of money after the death of the insured or a benefit on a specified date.

In the philippines, there are two major types of life insurance:

Traditional life and variable life.

Sun smarter life classic is a protection plan that provides double life insurance coverage, living benefits and more.

Get a quote within seconds today!

You are on the sun life financial philippines website.

Life insurance is more than just a death benefit your beneficiaries will receive when you pass away.

If you're looking to apply for life insurance in the philippines, you came to the right place.

From learning about basic life insurance terms to the application process, this post will have you covered.

What you get are disability, death, and living benefits.

Different types of life insurance.

Advisable ba ang life insurance?

Did you know that for as low as p10,000 you can get yourself yes, in the philippines, there are two types of insurance.

So you don't wanna use the traditional policy at the bloom.

Some passing and snacks uh.

Another popular philippine health insurance option is local private health cover available from local insurers.

These plans offer higher benefit levels than travel insurance policies, and can be largely tailored around the local.

Life basix of philippine axa life insurance.

Fwd life insurance corporation or simply fwd life was launched in 2014 in the philippines.

But currently, the company is now in 9th place in terms of premium then insurance looked bad for me after that.

I was the insured, then mom was the beneficiary.

Life insurance is essential if you want to ensure that have dependents.

In the unfortunate case of your passing, people will still continue to need your support.

This article provides several useful tips that will help you make the right … read more ».

But these days, life insurance has evolved into investment.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

Life insurance is for the purpose of your loved ones.

Our growing lists of life insurance products have been designed based on our customers' needs.

Have the confidence to follow your dreams knowing you and your loved ones' are protected from unexpected financial burdens of a critical illness and common diseases in the philippines.

One of the major insurance companies in philippines that provides a wide array of solutions that cover life, health, education, investment and retirement.

As your life insurance policy matures at the end of the policy term, all the maturity benefits of the policy, if any, will be paid off and the cover will cease.

Life insurance is a wonderful financial planning tool.

But the way it is sold in the market is very problematic.

Private health insurance gives those insured access to private healthcare networks.

A life insurance company has obligations to pay future claims:

Death, disability, hospitalisation and critical illness benefits.

He wants to educate the.

You could google what's the top 10 life insurance companies in the philippines to see who's leading.

The philippine health insurance corporation (philhealth) was created in 1995 to implement universal health coverage in the philippines.

Points to remember before buying philippines travellers medical insurance for usa.

Your residential status is essential to know if you are eligible for a particular plan.

Your residential status is essential to know if you are eligible for a particular plan. Life Insurance Benefits Philippines. Being aware of the cancellation and renewability policies.9 Jenis-Jenis Kurma TerfavoritTernyata Asal Mula Soto Bukan Menggunakan DagingResep Segar Nikmat Bihun Tom YamResep Garlic Bread Ala CeritaKuliner Buat Sendiri Minuman Detoxmu!!Stop Merendam Teh Celup Terlalu Lama!5 Makanan Pencegah Gangguan PendengaranNikmat Kulit Ayam, Bikin SengsaraTernyata Bayam Adalah Sahabat Wanita5 Cara Tepat Simpan Telur

Comments

Post a Comment