Life Insurance Benefits Received Are Taxable Income Income To The Beneficiary Is One Of The Main An Exception Is If You Receive Interest On A Benefit €� Any Interest That Has Been Earned Must Be Reported To The Irs And Is Potentially Subject To Income Tax.

Life Insurance Benefits Received Are Taxable Income. If Youpremiums Were Paid After Taxation, The Disability Income Benefits You Receive Are Not Taxable.

SELAMAT MEMBACA!

Learn how life insurance proceeds are generally not taxable to the beneficiary, but understand the unique situations in which taxes are assessed.

Life insurance proceeds are typically not taxable as income, but can be taxed as part of your estate if the amount being passed to your however, if your beneficiary receives the life insurance payment as a series of installments, the insurer will typically pay interest on the outstanding death benefit.

Life insurance death benefits are not taxable income, unless you receive money in excess of policy benefits.

Life insurance policies with a fixed or stated death benefit that's paid to the beneficiary generate no taxable income.

Here's when proceeds are taxable.

Life insurance proceeds aren't taxable.

If you're the beneficiary of a life insurance policy, the irs says you won't receive a 1099 for life insurance proceeds because the irs doesn't consider the death benefit to count as income.

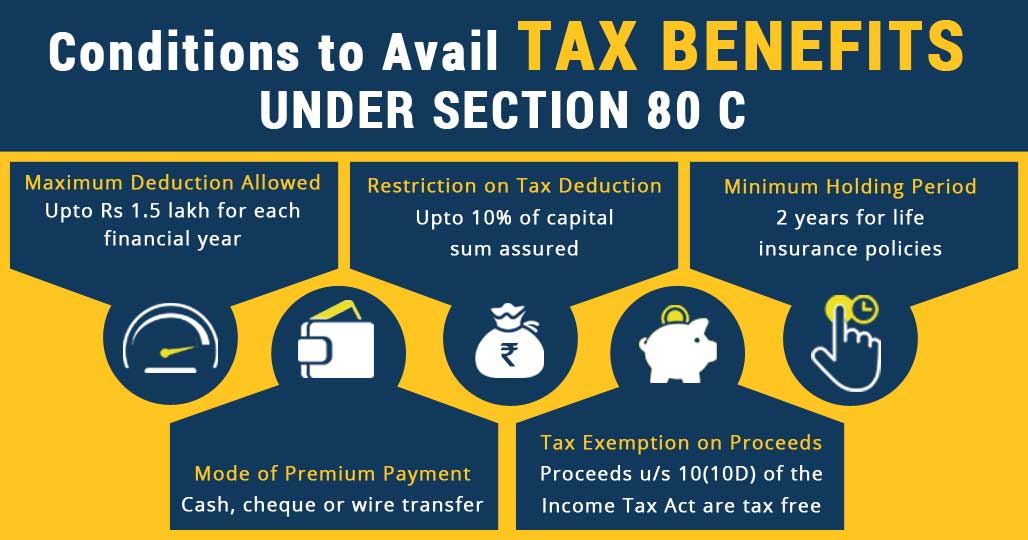

Purchasing life insurance is a must, especially if your spouse and children are dependent on your income to therefore, the insurance maturity proceeds are taxable, and not entitled to exemption under section.

No, life insurance benefits are, for the most part, not taxable unless the actual amount the beneficiary receives is more than what the policy states.

One important consideration to remember is that just because life insurance death benefits are almost always federal income tax free the death benefit.

The only way that it could be taxes is if you illegally deducted your premiums on your tax returns.

If youpremiums were paid after taxation, the disability income benefits you receive are not taxable.

The death claim received under life insurance policy is fully exempt in the hands of the nominees under section 10(10d).

Life insurance benefits are not considered taxable income by the irs, however, sometimes the policy owner can owe gift taxes when the policy pays out.

I received money from my deceased mom's life insurance.

Will i be taxed on this money or need to report it on my taxes as income?

The monthly income benefit and terminal benefit may be taxable subject to extra premium.

If you're shopping for a life insurance policy, you may be wondering if life insurance is taxable.

Income to the beneficiary is one of the main an exception is if you receive interest on a benefit — any interest that has been earned must be reported to the irs and is potentially subject to income tax.

One of the benefits of life insurance is that the premiums are low compared to the financial hardship on your family if you were to die unexpectedly.

The general rule is that life insurance beneficiaries don't have to report policy proceeds as taxable income.

Is life insurance taxable income in the uk?

If you have life insurance through your workplace (often called 'death in service' benefits or 'group life insurance') you as the employee won't normally have.

When your life insurance benefits earns income, it's taxable.

The beneficiary named in your life insurance policy receives proceeds from your policy upon although dividends are usually considered income, life insurance dividends are not taxable if the.

The exception is that you fooled around with the premium running it through a business and deducting what you shouldn't have deducted.

A cash surrender is taxable to the extent you get out more than you put in.

Generally, if you receive proceeds under a life insurance contract because of the death of the insured person, the benefits are not includable in gross income and do not have to be reported.

Learn all about life insurance dividends options, if they are taxable, and more.

The prudential insurance company of america pays dividends so that policyowners like you can benefit from the favorable experience of our participating individual life business.

Are life insurance payouts taxable?

Someone who receives a life insurance these are considered gifts and upon your death they are taxable if they exceed the inheritance tax.

Is life insurance payout taxable in australia?

Premiums are often tax deductible on a revenue protection structure, but benefits paid out are taxable.

Interest earned will be taxable as ordinary income when received or credited to payee.

At time of maturity or surrender, any.

When determining his or her taxable income, the beneficiary can exclude the benefits due to them at the time of the insured person's death.

Are group life and health insurance premiums taxable benefits?

However, your taxable income includes incentive awards and performance bonuses.

Are you starting a new job or enrolling in a benefits plan?

If you receive fringe benefits for services you render, they are usually considered taxable income, even if someone else receives them, such as your spouse.

The income you receive from disability benefits may or may not be taxable, depending on multiple factors.

Generally, if your employer paid the premiums, then the disability income is taxable to you.

So it's important to have the right answer to this question.

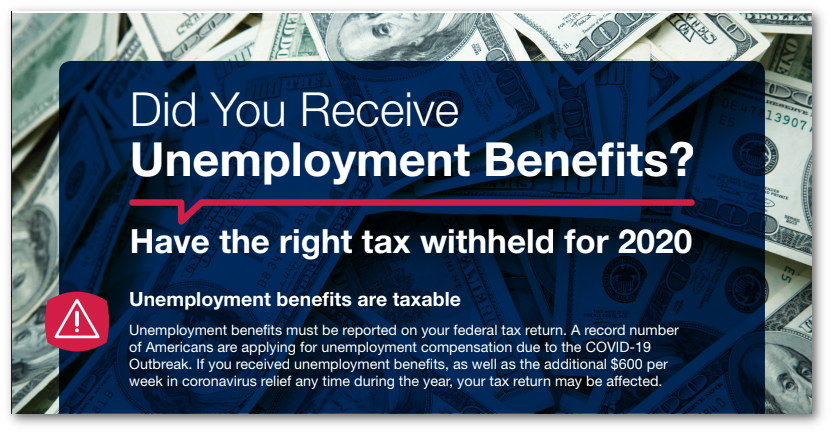

Most income you receive is fully taxable and must be reported on your federal income tax return unless it is specifically excluded by law.

Life insurance proceeds, which were paid to you because of the insured person's death, are generally not taxable unless the policy was turned over to you for a.

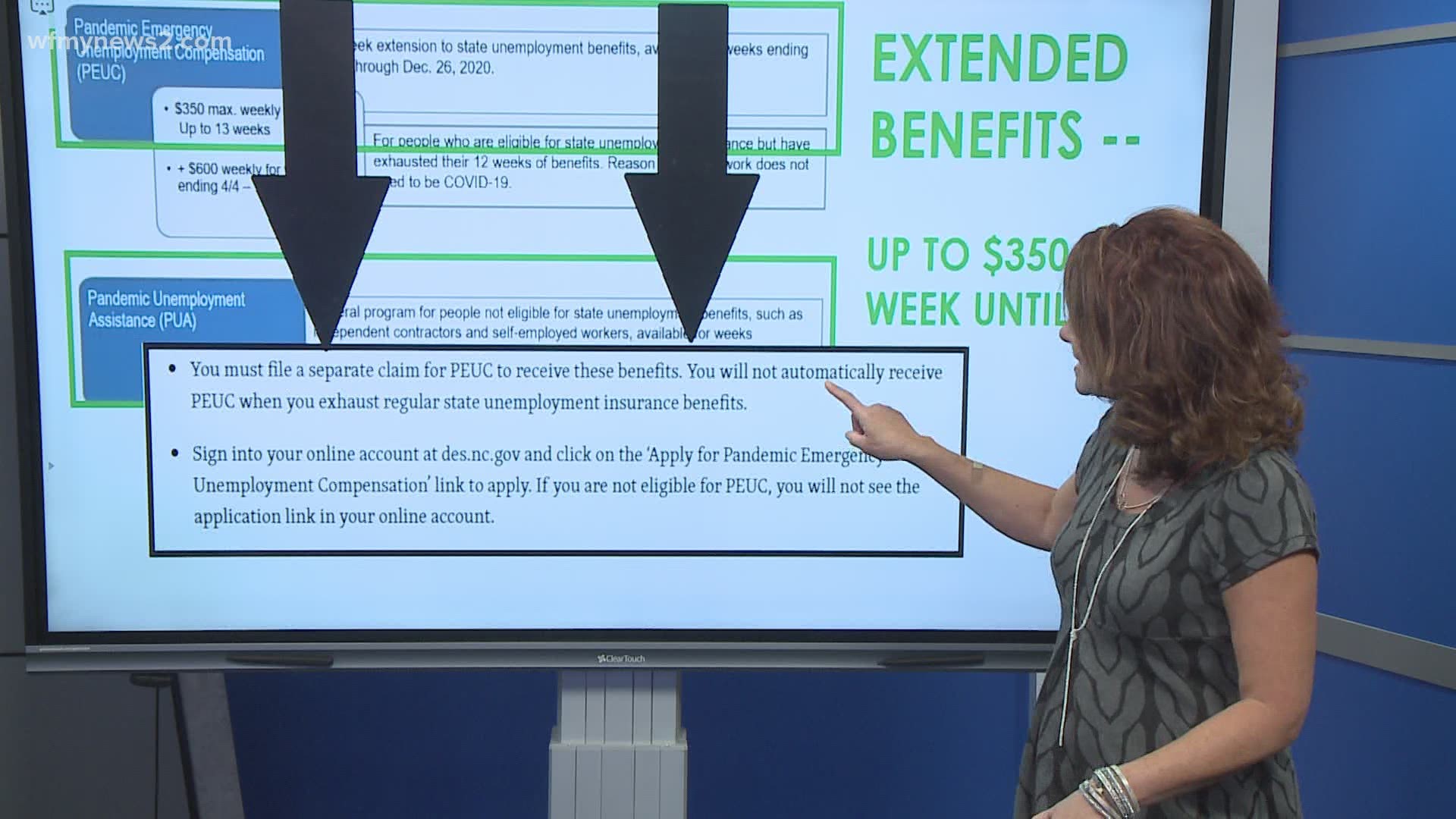

However, if you contribute to a special union fund and your payments to the fund are not deductible, you only need to include in your income the unemployment benefits that.

Ini Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatTernyata Inilah HOAX Terbesar Sepanjang MasaTernyata Tidur Bisa Buat Meninggal5 Manfaat Meredam Kaki Di Air Es5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuMulti Guna Air Kelapa HijauPD Hancur Gegara Bau Badan, Ini Solusinya!!Cara Benar Memasak SayuranIni Efek Buruk Overdosis Minum KopiSaatnya Minum Teh Daun Mint!!Taxable unemployment compensation generally includes, among other forms, state unemployment compensation benefits. Life Insurance Benefits Received Are Taxable Income. However, if you contribute to a special union fund and your payments to the fund are not deductible, you only need to include in your income the unemployment benefits that.

Find out if life insurance and disability insurance is taxable.

However, any interest you receive is taxable and you should report it as interest received.

See topic 403 for more information.

Life insurance proceeds are typically not taxable as income, but can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions.

Learn how life insurance proceeds are generally not taxable to the beneficiary, but understand the unique situations in which taxes are assessed.

Generally speaking, when the beneficiary of a life insurance policy receives the death benefit, this money is not counted as taxable income, and the.

Because proceeds from life insurance policies generally avoid taxation to the recipient, you will not receive a 1099 unless your life insurance payout counts as a taxable event.

Find out how it works.

Are life insurance proceeds taxable?

If you're wondering if your loved ones will get the full amount of the policy, you can rest assured that in most cases, the beneficiaries will you won't receive a 1099 for life insurance proceeds because the irs doesn't consider the death benefit to count as income.

However, if you have a life insurance policy life insurance dividends are only taxable to an extent.

If you do have a participating life insurance policy and receive dividends from the life.

In general, life insurance proceeds are not taxable, but there are a few exceptions.

For the most part, life insurance proceeds are not taxable.

Life insurance pay outs are usually not subject to income or capital gains tax.

However, it may be that the beneficiary or beneficiaries must pay inheritance tax.

Life insurance proceeds may require state tax payments at the estate level.

Under most circumstances, the life insurance death benefit proceeds do not create federal taxable income.

However, if you surrender a life insurance policy for reasons other than chronic or terminal illness.

Life insurance is almost always not taxable.

A life insurance payout isn't considered gross income.

The irs spells it out:

When is life insurance taxable?

Compare highly rated life insurance companies.

What is the goodman triangle?

Death benefit paid out to beneficiaries.

Are life insurance proceeds taxable?

Click here to learn all about the taxation of life insurance.

A life insurance tax shelter uses investments in insurance to protect income or assets from tax liabilities.

Life insurance proceeds are not taxable in many jurisdictions.

Since most other forms of income are taxable (such as capital gains, dividends and interest income).

However, there are certain situations whereby a when life insurance is taxable.

Irs tax on foreign life insurance income.

When it comes to foreign life insurance proceeds, it is important to distinguish between a return of basis and while the income generated from the foreign life insurance policy is taxable, the amount invested into the policy, or policy payments made on the.

Although this type of loan isn't treated as taxable income, it will have interest charged by the insurance company until you pay it back, and each insurance company has its own rates.

Is life insurance taxable income in the uk?

The amount they pay on it will, therefore, depend on their total income.

'life insurance proceeds' is another way to describe a life insurance payout, so please refer to the section above ' is life insurance taxed.

While life insurance proceeds that are paid to a beneficiary are tax free, any interest received off investments of those proceeds are taxable.

Looking at state specific municipal bonds can be a great way to remain conservative with your investments and generate income for yourself that is exempt.

Employees under this policy can add the cost of their insurance to their taxable income.

Are life insurance settlements taxed?

In addition to life insurance proceeds providing financially to loved ones who are left behind, there are several tax benefits.

Your beneficiaries can use it to pay off their debts, outstanding bills, mortgage, or any other financial need they might have.

This is one of the main reasons why life insurance remains an attractive option for people who want.

Learn when life insurance proceeds are taxable, when they aren't taxable, and how taxes on life insurance may impact your finances.

Do you pay taxes on life insurance?

Whether the policy proceeds might be subject to income taxes or estate taxes depends on how the policy is owned and how the beneficiary is named.

The general rule is that life insurance beneficiaries don't have to report policy proceeds as taxable income.

Determining the value to include depends on the insured person.

Accordingly, include all the proceeds if the owner insured their own life.

Is a life insurance payout taxable?

However, the death benefit could be taxable in a few situations—mostly for wealthy policyholders who use the word estate in their inheritance planning.

Although life insurance premiums, as such, are not deductible, they may be deductible as the payment of alimony or as charitable contributions.

Any increment in the value of prepaid life insurance or annuity premiums or premium deposit funds constitutes taxable income in the year it is applied to the.

When determining his or her taxable income, the beneficiary can exclude the benefits due to them at the time of the insured person's death.

Federal tax laws typically allow for life insurance proceeds to be treated as tax free income for the beneficiary; Life Insurance Benefits Received Are Taxable Income. When determining his or her taxable income, the beneficiary can exclude the benefits due to them at the time of the insured person's death.Resep Racik Bumbu Marinasi Ikan5 Trik Matangkan ManggaResep Nikmat Gurih Bakso LeleResep Ayam Suwir Pedas Ala CeritaKulinerCegah Alot, Ini Cara Benar Olah Cumi-CumiResep Cumi Goreng Tepung MantulIni Beda Asinan Betawi & Asinan BogorResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangNikmat Kulit Ayam, Bikin SengsaraPecel Pitik, Kuliner Sakral Suku Using Banyuwangi

Comments

Post a Comment