Life Insurance Benefits Taxable In Addition To Life Insurance Proceeds Providing A Financial Cushion To Loved Ones Who Are Left Behind, There Are Also Several Advantageous Tax Benefits That Go Along With Owning Certain Types Of Life Insurance Policy.

Life Insurance Benefits Taxable. Tax Benefits Are Subject To Changes In Tax Laws.

SELAMAT MEMBACA!

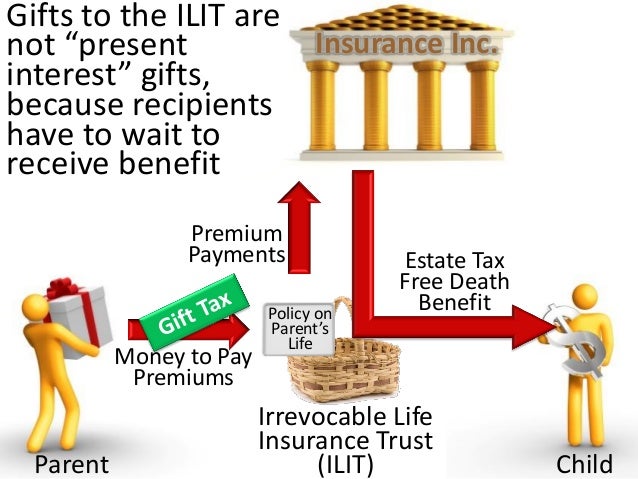

Using life insurance trusts to avoid taxation.

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.

However, any interest you receive is taxable and you should report it as interest received.

Many whole life insurance plans, in addition to providing the insured with a fixed death benefit, also accumulate cash value as policyholders pay into there is a misconception that the proceeds from this kind of loan are taxable.

Since life insurance death benefits can be in the millions of dollars, it's a significant advantage to buying (and receiving) life insurance.

Life insurance proceeds are typically not taxable as income, but can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions.

While an ilit is an effective way to make sure that your life insurance death benefit is not taxable as part of your estate.

When is a life insurance payout not taxable?

Generally, life insurance benefits paid out to individual beneficiaries aren't subject to federal income tax.

That's because you don't have to include life insurance payouts in your gross income or report them to the irs.

Interest is taxable to the beneficiary.

If your policy is set up to hold the $50,000 and pay.

For the most part, life insurance proceeds are not taxable.

Another life insurance tax benefit kicks in if you decide to borrow against your cash value.

Although this type of loan isn't treated as taxable income, it will have interest charged by the insurance company until you pay it back, and each insurance company has its own rates.

Death benefits on an individual's life insurance policy are not considered taxable income, says drew tignanelli, president of the financial consulate, a financial planning firm in hunt valley, md.

When is life insurance taxable?

Most of the time, you're free and clear of taxes when receiving a death benefit.

If your spouse or children are named as the beneficiaries of your life insurance, the death benefit is not counted as part of your estate.

Life insurance, including death benefits, is usually not taxable since it isn't considered taxable income.

However, there are situations when money from a tax benefit may get taxed.

Life insurance is almost always not taxable.

Life insurance interest that's received can affect both, but only the interest received on the life insurance benefits is taxable.

Early surrender of whole life insurance.

If you have term life insurance and cancel your contract, there are no tax consequences.

Purchasing life insurance is a must, especially if your spouse and children are dependent on your income to therefore, the insurance maturity proceeds are taxable, and not entitled to exemption under section.

Check life insurance tax benefits under section 80c, 80ccc, 80d & 80dd of the income tax act, 1961.

Tax benefits are subject to changes in tax laws.

Death benefits aren't normally subject to income tax, but they they're only $1 million in massachusetts and oregon in 2021. when death benefits are taxable.

The death benefits paid on life insurance policies.

When is life insurance taxable?

What is the goodman triangle?

Death benefit paid out to beneficiaries.

Most people buy life insurance so they can leave money to their beneficiaries when they die.

You pay premiums on the policy, and if the policy is still in force at your death, the the first caveat is that any interest paid on life insurance benefits counts as taxable interest.

When is life insurance taxable?

Here are some situations in which the government may claim a share of life insurance benefits the difference is considered taxable at ordinary income tax rates, explains patrick ritter, a financial planning consultant at fiduciary advisors in st.

Those, and the ways the taxable amounts are calculated, are explained below.

Many people think about life insurance as strictly a death benefit.

A few more savvy individuals know that this death benefit is not taxable to the beneficiaries.

Your life insurance policy offers you dual benefits:

Comprehensive financial protection against unforeseen events for your family.

Proceeds of key man insurance is taxable.

Are life insurance payouts taxable?

When a life insurance policy pays out money, the payout is tax free.

In other words, the person or people who receive the payout do not who benefits from a life insurance policy in the uk?

In addition to life insurance proceeds providing a financial cushion to loved ones who are left behind, there are also several advantageous tax benefits that go along with owning certain types of life insurance policy.

Normally, no, but some exceptions do exist.

Here's what to know if you need that financial support in the event the worst comes to pass.

Your family will be thankful you considered their future.

The primary insured is the life that the policy is based on.

If this person dies during the contract, the life insurance company would pay a benefit to the beneficiaries of the policy.

However, under some circumstances, they might be.

You've paid a premium, maybe over the years, or maybe all at once.

You paid the premiums with money already taxed in your income.

It's a good idea to consult with your agent or financial advisor if you have any questions about your life insurance policy.

Ini Cara Benar Cegah HipersomniaSehat Sekejap Dengan Es BatuMulti Guna Air Kelapa HijauSaatnya Bersih-Bersih UsusTernyata Menikmati Alam Bebas Ada Manfaatnya4 Titik Akupresur Agar Tidurmu NyenyakTernyata Tidur Terbaik Cukup 2 Menit!Ternyata Jangan Sering Mandikan BayiSalah Pilih Sabun, Ini Risikonya!!!5 Khasiat Buah Tin, Sudah Teruji Klinis!!Life insurance benefits are generally not federally taxable, but each policy is different and each state's tax rules may vary. Life Insurance Benefits Taxable. It's a good idea to consult with your agent or financial advisor if you have any questions about your life insurance policy.

Another life insurance tax benefit kicks in if you decide to borrow against your cash value.

Life insurance policies can be useful tax planning tools, because the policyholder is eligible for tax benefits under the income tax act 1961 (act).

There are two kinds of income tax benefits available to individuals with respect to long term savings being made in life insurance policies

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.

Many whole life insurance plans, in addition to providing the insured with a fixed death benefit, also accumulate cash there is a misconception that the proceeds from this kind of loan are taxable.

That is not the case, even when the loan amount exceeds the total.

But there are times when money from a policy is taxable.

Are life insurance benefits taxable?

Life insurance death proceeds are generally not taxable income to the beneficiary, but there may still be life insurance tax implications depending on how the benefits are paid out and the type of policy you have.

No, life insurance benefits are, for the most part, not taxable unless the actual amount the beneficiary receives is more than what the policy states.

Although rare, the life insurance payout can be taxable in the following situations:

The insurer issues the death benefit in installments.

One way to keep your life insurance death benefit out of your estate is to transfer ownership to someone else before you die.

Here are some situations in which the government may claim a share of life insurance benefits if you sell your life insurance policy, the buyer will pay the premiums and receive the cash benefit upon your death.

Life insurance, including death benefits, is usually not taxable since it isn't considered taxable income.

The irs spells it out:

When is a life insurance payout not taxable?

Generally, life insurance benefits paid out to individual beneficiaries aren't subject to federal income tax.

That's because you don't have to include life insurance payouts in your gross income or report them to the irs.

The capital benefits that come with life insurance help your family build a safe and safeguarded future, even in your absence.

Moreover, under section 80c and 10d of the income tax act, there are income tax benefits on life insurance.

The tax benefits of life insurance are well documented and were even held up in the early 1980's.

Is life insurance taxable if you cash it in?

In most cases, your beneficiary won't have to pay taxes on the death benefit.

You won't receive a 1099 for life insurance proceeds because the irs doesn't consider the death benefit to count as income.

To highlight, there are two types of income tax benefits available to individuals concerning the savings being made in the life insurance policies

Is a life insurance payout taxable?

The death benefit (or payout, or proceeds) of a life insurance policy isn't taxable most of the time.

When is life insurance taxable?

Compare highly rated life insurance companies.

What is the goodman triangle?

Most people buy life insurance so they can leave money to their beneficiaries when they die.

Tax benefits on life insurance.

Life insurance helps you to save taxes in number of ways.

Tax deduction under section 80c of the income tax act, 1961, allows exemption up to rs.1.5 lakh per.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Whether your life insurance payout is taxable in australia generally depends on your policy ownership structure:

For instance, a life insurance benefit paid directly to your spouse or child is generally not subject to taxation when the.

Many people think about life insurance as strictly a death benefit.

A few more savvy individuals know that this death benefit is not taxable to the beneficiaries.

When you buy life insurance there are three parties involved;

The owner, the beneficiary and the person who is insured.

If you go this route and then die, the death benefit becomes taxable income.

Life insurance, on the other hand, is an exception to the principle that insurance is a contract of indemnity.

The proceeds of the policy are typically included in the estate of the insured, and thus they are subject to taxation in the taxable portion of the estate.

Other taxable benefits of permanent insurance.

It is always best to talk to tax consultant or.

Life insurance policies can carry a host of tax consequences for policyholders and beneficiaries that can easily catch you by surprise.

Bearing that in the mind, your life insurance policy may entail the following tax benefits. Life Insurance Benefits Taxable. In addition to life insurance proceeds providing a financial cushion to loved ones who are left behind, there are also several advantageous tax benefits that go along with owning certain types of life insurance policy.3 Jenis Daging Bahan Bakso TerbaikResep Yakitori, Sate Ayam Ala JepangResep Garlic Bread Ala CeritaKuliner Resep Beef Teriyaki Ala CeritaKulinerResep Ayam Suwir Pedas Ala CeritaKulinerBir Pletok, Bir Halal BetawiNanas, Hoax Vs Fakta9 Jenis-Jenis Kurma TerfavoritPete, Obat Alternatif DiabetesFoto Di Rumah Makan Padang

Comments

Post a Comment