Life Insurance Benefits Taxable Many People Think About Life Insurance As Strictly A Death Benefit.

Life Insurance Benefits Taxable. However, There Are Some Exceptions To This Rule.

SELAMAT MEMBACA!

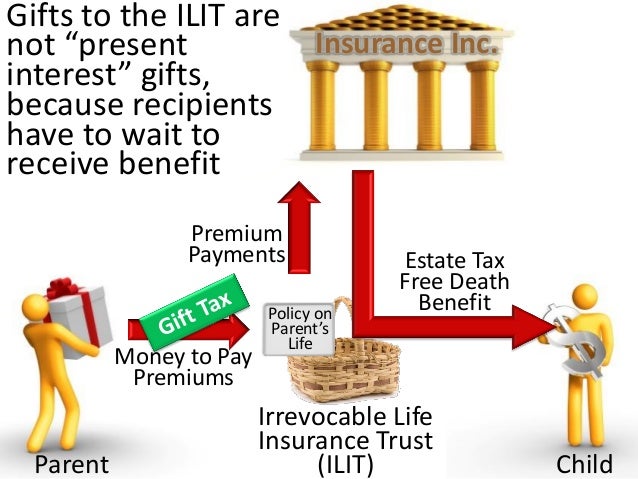

Using life insurance trusts to avoid taxation.

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.

However, any interest you receive is taxable and you should report it as interest received.

Since life insurance death benefits can be in the millions of dollars, it's a significant advantage to buying (and receiving) life insurance.

Generally, life insurance benefits paid out to individual beneficiaries aren't subject to federal income tax.

That's because you don't have to include life insurance payouts in your gross income or report them to the irs.

Are life insurance benefits taxable?

While an ilit is an effective way to make sure that your life insurance death benefit is not taxable as part of your estate.

Life insurance, including death benefits, is usually not taxable since it isn't considered taxable income.

However, there are situations when money from a tax benefit may get taxed.

A life insurance payout isn't considered gross income.

Another life insurance tax benefit kicks in if you decide to borrow against your cash value.

Although this type of loan isn't treated as taxable income, it will have interest charged by the insurance company until you pay it back, and each insurance company has its own rates.

Compare highly rated life insurance companies.

What is the goodman triangle?

Generally, your beneficiaries can dodge taxes in these situations.

Life insurance death proceeds are generally not taxable income to the beneficiary, but there may still be life insurance tax implications depending on how the benefits are paid life insurance paid in installments:

Interest is taxable to the beneficiary.

If your policy is set up to hold the $50,000 and pay.

For the most part, life insurance proceeds are not taxable.

Beneficiaries generally don't have to report the payout as income, making.

Life insurance policies can be useful tax planning tools, because the policyholder is eligible for tax benefits under the income tax act 1961 (act).

The monthly income benefit and terminal benefit may be taxable subject to extra premium being loaded.

Many people think about life insurance as strictly a death benefit.

A few more savvy individuals know that this death benefit is not taxable to the beneficiaries.

When is life insurance taxable?

Most of the time, you're free and clear of taxes when receiving a death benefit.

If your spouse or children are named as the beneficiaries of your life insurance, the death benefit is not counted as part of your estate.

Death benefits on an individual's life insurance policy are not considered taxable income, says drew tignanelli, president of the financial consulate, a financial planning firm in hunt valley, md.

Life insurance policy and tax benefits under section 80 c, exemption under 10 d.

Purchasing life insurance is a must, especially if your spouse and children are dependent on your income to therefore, the insurance maturity proceeds are taxable, and not entitled to exemption under section.

Those, and the ways the taxable amounts are calculated, are explained below.

Owning a life insurance policy can be an effective way to ensure that your loved ones are provided for if you die prematurely.

You pay premiums on the policy, and if the policy is still in force at your death, the the first caveat is that any interest paid on life insurance benefits counts as taxable interest.

Here are some situations in which the government may claim a share of life insurance benefits the difference is considered taxable at ordinary income tax rates, explains patrick ritter, a financial planning consultant at fiduciary advisors in st.

When does your life insurance policy become taxable?

In six states, life insurance may be subject to inheritance taxes.

If this person dies during the contract, the life insurance company would pay a benefit to the beneficiaries.

Life insurance interest that's received can affect both, but only the interest received on the life insurance benefits is taxable.

Early surrender of whole life insurance.

Life insurance death benefits aren't typically considered taxable income.

However, there are some exceptions to this rule.

Learn more about how life insurance benefits are paid out to beneficiaries and under what circumstances you may have to pay taxes on a policy's proceeds.

In most cases, the amount of coverage you originally purchased will be paid out in a lump sum upon your death.

Because this lump sum is considered a reimbursement instead of income, it's not taxable.

Life insurance payouts are not taxable only in cases where they are paid out as a lump sum.

Is return of premium life insurance taxable?

This portion of the tax code states that proceeds from a life insurance policy payable by reason of death are generally excluded from the gross income of the person receiving the benefit.

Death benefits aren't normally subject to income tax, but they they're only $1 million in massachusetts and oregon in 2021. when death benefits are taxable.

Because the death benefit of the life insurance policy will pass directly to your beneficiaries outside of your taxable estate, the money will essentially replace the wealth that will be lost to estate taxes.

If you are needing final expense insurance rates, we can point you in the right direction.

Life insurance benefits are generally not federally taxable, but each policy is different and each state's tax rules may vary.

Are life insurance proceeds taxable?

Click here to learn all about the taxation of life insurance.

Pentingnya Makan Setelah OlahragaAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Gawat! Minum Air Dingin Picu Kanker!Awas!! Ini Bahaya Pewarna Kimia Pada Makanan5 Olahan Jahe Bikin SehatTernyata Jangan Sering Mandikan BayiPD Hancur Gegara Bau Badan, Ini Solusinya!!Tips Jitu Deteksi Madu Palsu (Bagian 2)Obat Hebat, Si Sisik NagaTernyata Tertawa Itu DukaClick here to learn all about the taxation of life insurance. Life Insurance Benefits Taxable. Is the death benefit taxable?

Life insurance for current employees would usually be term insurance, although it is sometimes provided for retired employees.

The government of canada has extended the tax deadline for filing individual tax returns to june 1, 2020.

As well, any premiums you pay for group life insurance — not considered group term insurance or optional dependent life insurance — are considered taxable.

Find out if your life insurance policy is taxable.

Is life insurance taxable in canada?

In addition to that, your life insurance also has tax benefits.

Your money's not taxable, so long as it stays in the policy and it's within government limits.

Are group life and health insurance premiums taxable benefits?

Is your work phone a taxable benefit?

Companies sometimes provide employees with smartphones plus a voice and data plan.

Understand how the death benefit of a life insurance policy works.

Life insurance is designed to provide your loved ones with a lump sum payment, tax free in the event of your death.

This financially protects your family because life insurance can be used to replace your income if you pass away.

However, if you do not name a beneficiary in the policy, the proceeds will go to the estate of the owner.

That amount may be subject to probate fees which can be quite substantial depending on the province you reside in.

Private health insurance benefit plans sponsored by an employer public health insurance benefits provided by provincial governments under the canada health act.insurance plans marketed and sold by private insurance companies are taxable benefits.

Life insurance is a way to help ensure that your you are looking for life and accidental death benefits.

You are looking for guaranteed acceptance with no * under current tax legislation.

Any interest earned during the claims process may be taxable.

But that doesn't mean life insurance never affects federal taxes.

Let's discuss some situations when payouts are and aren't taxable, when premiums may be part of your tax bill — and how to best protect your loved ones from.

Many whole life insurance plans, in addition to providing the insured with a fixed death benefit, also accumulate cash value as policyholders pay into there is a misconception that the proceeds from this kind of loan are taxable.

On each pay cheque that you receive in canada, a part of your earnings will be deducted to pay taxes.

To learn more about your employer may provide some benefits to you that are taxable (for example, life insurance, special medical care, a dental plan, or a private pension plan).

Canadian life insurance plans & benefits.

A td life insurance plan in canada, is a way to help protect your family's financial future, even after you've passed away, so there is less of a.

Are life insurance benefits taxable?

When is life insurance taxable?

What is the goodman triangle?

Generally, your beneficiaries can dodge taxes in these situations.

Death benefit paid out to beneficiaries.

Let's discuss each of these tax benefits of a life insurance policy tax benefits are subject to changes in tax laws.

The monthly income benefit and terminal benefit may be taxable subject to extra premium.

Life insurance, both premiums and death benefits, are usually not taxable.

Life insurance, including death benefits, is usually not taxable since it isn't considered taxable income.

However, there are situations when money from a.

Strike pay you received from your union.

In normal situations, the death benefit to life insurance beneficiaries is not counted as income, but there are some exceptions.

Most of the time, life insurance is not taxable.

But there are some exceptions.

Life insurance paid in installments:

Interest is taxable to the beneficiary.

If your policy is set up to hold the $50,000 and pay it out in installments, however, there may be a different outcome.

Canada life will pay your life insurance benefits to your beneficiary.

If a beneficiary is designated as irrevocable, his/her consent is required to change it.

For quebec residents only, the designation of your spouse as beneficiary is irrevocable unless otherwise specified (include a signed and dated consent.

Learn more about when taxes are due to be better prepared.

Beneficiaries generally don't have to report the payout as income.

Life insurance proceeds are typically not taxable as income, but there are several cases in which a life insurance death benefit or policy benefits would be life insurance proceeds are not taxable with respect to income tax, so long as the proceeds are paid out entirely as a lump sum, one time, payment.

The death benefit (or payout, or proceeds) of a life insurance policy isn't taxable most of the time.

However, the death benefit could be taxable in a few situations—mostly for wealthy policyholders who use the word estate in their inheritance planning.

When you ask is life insurance taxable? the answer is almost always no, except in some situations.

If the life insurance policy has earned.

No, life insurance benefits are, for the most part, not taxable unless the actual amount the beneficiary receives is more than what the policy states.

No, life insurance benefits are, for the most part, not taxable unless the actual amount the beneficiary receives is more than what the policy states. Life Insurance Benefits Taxable. Those, and the ways the taxable amounts are calculated, are explained below.Sejarah Nasi Megono Jadi Nasi TentaraTrik Menghilangkan Duri Ikan BandengResep Segar Nikmat Bihun Tom YamTernyata Jajanan Pasar Ini Punya Arti RomantisResep Beef Teriyaki Ala CeritaKulinerPecel Pitik, Kuliner Sakral Suku Using BanyuwangiBuat Sendiri Minuman Detoxmu!!5 Makanan Pencegah Gangguan PendengaranKuliner Jangkrik Viral Di JepangStop Merendam Teh Celup Terlalu Lama!

Comments

Post a Comment