Life Insurance Benefits Taxable Most People Buy Life Insurance So They Can Leave Money To Their Beneficiaries When They Die.

Life Insurance Benefits Taxable. Most People Buy Life Insurance So They Can Leave Money To Their Beneficiaries When They Die.

SELAMAT MEMBACA!

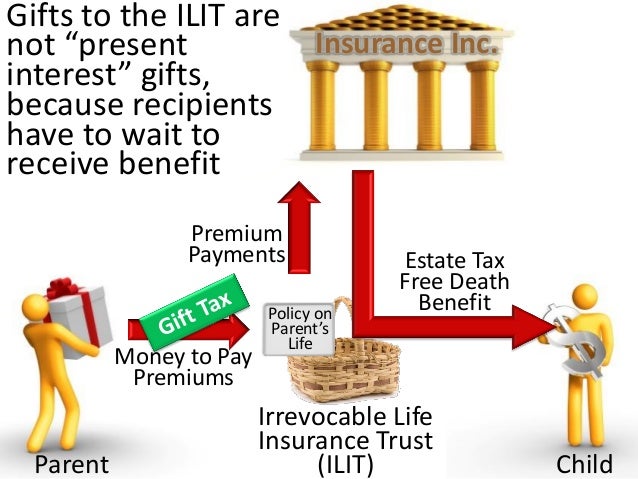

Using life insurance trusts to avoid taxation.

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.

However, any interest you receive is taxable and you should report it as interest received.

Many whole life insurance plans, in addition to providing the insured with a fixed death benefit, also accumulate cash value as policyholders pay into there is a misconception that the proceeds from this kind of loan are taxable.

Since life insurance death benefits can be in the millions of dollars, it's a significant advantage to buying (and receiving) life insurance.

Life insurance proceeds are typically not taxable as income, but can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions.

While an ilit is an effective way to make sure that your life insurance death benefit is not taxable as part of your estate.

When is a life insurance payout not taxable?

Generally, life insurance benefits paid out to individual beneficiaries aren't subject to federal income tax.

That's because you don't have to include life insurance payouts in your gross income or report them to the irs.

Interest is taxable to the beneficiary.

If your policy is set up to hold the $50,000 and pay.

For the most part, life insurance proceeds are not taxable.

Another life insurance tax benefit kicks in if you decide to borrow against your cash value.

Although this type of loan isn't treated as taxable income, it will have interest charged by the insurance company until you pay it back, and each insurance company has its own rates.

Death benefits on an individual's life insurance policy are not considered taxable income, says drew tignanelli, president of the financial consulate, a financial planning firm in hunt valley, md.

When is life insurance taxable?

Most of the time, you're free and clear of taxes when receiving a death benefit.

If your spouse or children are named as the beneficiaries of your life insurance, the death benefit is not counted as part of your estate.

Life insurance, including death benefits, is usually not taxable since it isn't considered taxable income.

However, there are situations when money from a tax benefit may get taxed.

Life insurance is almost always not taxable.

Life insurance interest that's received can affect both, but only the interest received on the life insurance benefits is taxable.

Early surrender of whole life insurance.

If you have term life insurance and cancel your contract, there are no tax consequences.

Purchasing life insurance is a must, especially if your spouse and children are dependent on your income to therefore, the insurance maturity proceeds are taxable, and not entitled to exemption under section.

Check life insurance tax benefits under section 80c, 80ccc, 80d & 80dd of the income tax act, 1961.

Tax benefits are subject to changes in tax laws.

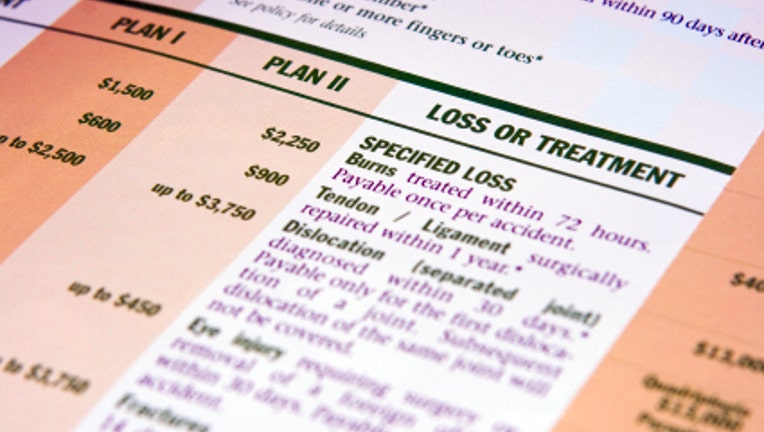

Death benefits aren't normally subject to income tax, but they they're only $1 million in massachusetts and oregon in 2021. when death benefits are taxable.

The death benefits paid on life insurance policies.

When is life insurance taxable?

What is the goodman triangle?

Death benefit paid out to beneficiaries.

Most people buy life insurance so they can leave money to their beneficiaries when they die.

You pay premiums on the policy, and if the policy is still in force at your death, the the first caveat is that any interest paid on life insurance benefits counts as taxable interest.

When is life insurance taxable?

Here are some situations in which the government may claim a share of life insurance benefits the difference is considered taxable at ordinary income tax rates, explains patrick ritter, a financial planning consultant at fiduciary advisors in st.

Those, and the ways the taxable amounts are calculated, are explained below.

Many people think about life insurance as strictly a death benefit.

A few more savvy individuals know that this death benefit is not taxable to the beneficiaries.

Your life insurance policy offers you dual benefits:

Comprehensive financial protection against unforeseen events for your family.

Proceeds of key man insurance is taxable.

Are life insurance payouts taxable?

When a life insurance policy pays out money, the payout is tax free.

In other words, the person or people who receive the payout do not who benefits from a life insurance policy in the uk?

In addition to life insurance proceeds providing a financial cushion to loved ones who are left behind, there are also several advantageous tax benefits that go along with owning certain types of life insurance policy.

Normally, no, but some exceptions do exist.

Here's what to know if you need that financial support in the event the worst comes to pass.

Your family will be thankful you considered their future.

The primary insured is the life that the policy is based on.

If this person dies during the contract, the life insurance company would pay a benefit to the beneficiaries of the policy.

However, under some circumstances, they might be.

You've paid a premium, maybe over the years, or maybe all at once.

You paid the premiums with money already taxed in your income.

It's a good idea to consult with your agent or financial advisor if you have any questions about your life insurance policy.

Ternyata Tidur Terbaik Cukup 2 Menit!Ternyata Menikmati Alam Bebas Ada Manfaatnya8 Bahan Alami Detox 5 Manfaat Meredam Kaki Di Air EsMengusir Komedo Membandel - Bagian 2Saatnya Bersih-Bersih Usus7 Makanan Sebabkan SembelitMulai Sekarang, Minum Kopi Tanpa Gula!!Vitalitas Pria, Cukup Bawang Putih SajaMengusir Komedo MembandelLife insurance benefits are generally not federally taxable, but each policy is different and each state's tax rules may vary. Life Insurance Benefits Taxable. It's a good idea to consult with your agent or financial advisor if you have any questions about your life insurance policy.

Taxes on life insurance premiums.

Another life insurance tax benefit kicks in if you decide to borrow against your cash value.

As an additional example of the benefits that come with a whole life insurance policy, there are ways.

For example, in maryland, life insurance benefits of more than $1 million are subject to the state's estate tax.

Secure your family against unexpected situations.

Get your free quote with personalized features that best suits your needs and requirements.

Selling your life insurance policy — often called a life settlement — can get you more money than surrendering it.

Life insurance policies can carry a host of tax consequences for policyholders and beneficiaries that can easily catch you by surprise.

It's important to understand if and when your family will need to pay taxes, so they're not hit with a surprise bill during an here's a closer look at some of the most common questions about life insurance and taxes.

Your life insurance policy offers you dual benefits:

Any sum received from life insurance policy as maturity proceeds, death benefits is tax free subject to fulfillment of the conditions mentioned therein.

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you if you pay the entire cost of a health or accident insurance plan, don't include any amounts you receive for your disability as income on your tax return.

Some sophisticated life insurance plans have different tax implications.

This tax shield becomes more effective as the policy ages.

In addition, steve has the option to borrow against his.

Understand the income tax benefits on life insurance policies under section 80c and section 10d of income tax act 1961.

When a life insurance policy pays out money, the payout is tax free.

In other words, the person or people who receive the payout do not automatically have to pay tax on the who benefits from a life insurance policy in the uk?

Someone who receives a life insurance payout is known as a beneficiary.

Lump sum payouts, by comparison, are.

Nearly everyone understands that the death benefit of life insurance is tax free.

Done properly, the tax benefits of life insurance make it one of the most attractive non market correlated assets classes in existence today.

If you have paid an insurance premium to insure your own life or the life of your spouse or child, such premium payments are eligible for deduction under section 80c of the income tax act.

There are some conditions which a life insurance for all policies purchased after 1st april, 2012 the tax benefits would apply only if the sum assured is at least 10 times the annual income.

The death benefit of your permanent life insurance is generally passed on to your beneficiaries free from federal income tax.

Because a life insurance death benefit is tax free, a policyholder and heirs can come out ahead with a policy purchased in the retirement years even if premiums are very high.

Questions about life insurance and taxes are common questions for our licensed agents.

Some of the most common questions are listed below.

Death benefits are not taxed.

However, you will need to pay any.

Because a life insurance death benefit is tax free, a policyholder and heirs can come out ahead with a policy purchased in the retirement years even if premiums are very high.

Generally, life insurance premiums are not tax deductible.

Tax advantages of life insurance living benefits.

This is where it really gets good

In the following we are going to explore the specific tax questions we answer most often, then go over some events that could.

No, life insurance benefits are, for the most part, not taxable unless the actual amount the beneficiary receives is more than what the policy states.

One important consideration to remember is that just because life insurance death benefits are almost always federal income tax free the death benefit.

Know the difference between life insurance and general insurance, life insurance is a way to help protect your loved ones financially and general insurance helps us protect ourselves.

Is your life insurance tax free?

When life insurance benefits are paid to your designated beneficiary, they pass free of income tax.

Discover how life insurance payouts are taxed, how it might affect your beneficiaries and if you can claim life insurance premiums on your tax return.

Tax benefits on life insurance.

Here's a simple guide to save taxes with life insurance policies.

And we all look forward to the new year.

Learn all about life insurance income tax exemptions, while you build a corpus and secure your family. Life Insurance Benefits Taxable. And we all look forward to the new year.Resep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangResep Selai Nanas HomemadeResep Beef Teriyaki Ala CeritaKulinerResep Ayam Suwir Pedas Ala CeritaKulinerBir Pletok, Bir Halal BetawiResep Cream Horn Pastry3 Jenis Daging Bahan Bakso TerbaikSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanResep Ponzu, Cocolan Ala Jepang5 Cara Tepat Simpan Telur

Comments

Post a Comment