Life Insurance Benefits Taxed Bearing That In The Mind, Your Life Insurance Policy May Entail The Following Tax Benefits.

Life Insurance Benefits Taxed. So Let Us Summarize Them For A Better Understanding.

SELAMAT MEMBACA!

Life insurance premiums, under most circumstances, are not taxed (i.e., no sales tax is added or charged).

Returns generated from whole life insurance policies are not taxed until the policy is cashed out.

Life insurance policies can be useful tax planning tools, because the policyholder is eligible for tax benefits under the income tax act 1961 (act).

There are two kinds of income tax benefits available to individuals with respect to long term savings being made in life insurance policies

Are life insurance proceeds taxable?

Cases in which life insurance is taxed.

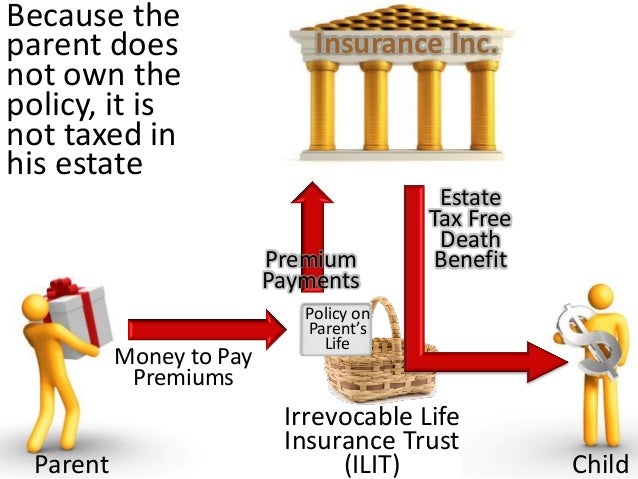

Federal estate taxes must be paid on life insurance benefits above $5.25 million in 2013, but only if the policy was owned by the deceased if a life insurance policy is owned by the beneficiaries, they won't have to pay an estate tax, he says.

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you if you pay the entire cost of a health or accident insurance plan, don't include any amounts you receive for your disability as income on your tax return.

Understand the income tax benefits on life insurance policies under section 80c and section 10d of income tax act 1961.

To know more about section 80c and section 10d, visit now!

Life insurance helps you to save taxes in number of ways.

If you have ever wondered you can avail tax benefits on premiums paid for a life insurance policy.

Tax deduction under section 80c of the income tax act, 1961, allows exemption up to rs.1.5 lakh per.

The insurer issues the death benefit in installments.

If you want to get out of a life insurance policy and buy another one, you may be better off trading it as part of a 1035 exchange — a provision in the u.s.

The tax benefits of life insurance are well documented and were even held up in the early 1980's.

Life insurance payments to a spouse typically aren't subject to federal income taxes or estate taxes.

If you sell your life insurance policy, the buyer will pay the premiums and receive the cash benefit upon your death.

The money you get from selling your policy may be taxed.

Life insurance policy and tax benefits under section 80 c, exemption under 10 d.

If you have paid an insurance premium to insure your own life or the life of your spouse or child, such premium payments are eligible for deduction under section 80c of the income tax act.

Generally, life insurance premiums are not tax deductible.

This is where it really gets good

Life insurance policies can carry a host of tax consequences for policyholders and beneficiaries that can easily catch you by surprise.

Bearing that in the mind, your life insurance policy may entail the following tax benefits.

Icici prudential life insurance company limited expressly disclaims any liability to any person, if tax benefits stated above are denied to the customer.

Generally speaking, a beneficiary to a life insurance policy does not pay federal income tax on the death benefit.

There are two exceptions to this rule:

Income tax benefits may be available as per the prevailing income tax laws, subject to fulfilment of conditions stipulated therein.

Tata aia life insurance company ltd.

Does not assume responsibility on tax implication mentioned anywhere in this document.

So let us summarize them for a better understanding.

It is commonly known fact and widely utilized tool that life insurance is a best tax saving option.

But only few know about the tax implications of maturity, surrender or.

How does the irs tax life insurance proceeds?

Most people who buy life insurance pay for it in a series of premiums.

When the policyholder dies, the beneficiaries receive the death benefit in a lump sum.

Our guide to life insurance tax outlines how to get tax free life insurance and compare quotes.

Who benefits from a life insurance policy in the uk?

Someone who receives a life insurance payout is known as a beneficiary.

No, life insurance benefits are, for the most part, not taxable unless the actual amount the beneficiary receives is more than what the policy states.

One important consideration to remember is that just because life insurance death benefits are almost always federal income tax free the death benefit.

Life insurance for tax benefits.

That being said, life insurance, in general, doesn't come under the strict radar of taxation, at least when compared to other financial instruments.

There are certain exemptions and tax benefits one can take advantage of if the circumstance and situation allow it.

These payouts are comprised of taxed contributions the life insured has made to their super fund.

It also allow you tax exemption in respect of the life insurance policy.

Under section 80c of income tax act, you can claim deduction for life insurance premium (lip) paid by you upto rs.

1.50 lakhs in a year along with.

So that rules out everything except income protection insurance.

Are life insurance benefits taxed in australia?

Are life insurance benefits taxed in australia? Life Insurance Benefits Taxed. The type of life insurance you have, how you bought it, and even who the beneficiary is.

Life insurance premiums, under most circumstances, are not taxed (i.e., no sales tax is added or charged).

Returns generated from whole life insurance policies are not taxed until the policy is cashed out.

Life insurance policies can be useful tax planning tools, because the policyholder is eligible for tax benefits under the income tax act 1961 (act).

There are two kinds of income tax benefits available to individuals with respect to long term savings being made in life insurance policies

Are life insurance proceeds taxable?

Cases in which life insurance is taxed.

Federal estate taxes must be paid on life insurance benefits above $5.25 million in 2013, but only if the policy was owned by the deceased if a life insurance policy is owned by the beneficiaries, they won't have to pay an estate tax, he says.

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you if you pay the entire cost of a health or accident insurance plan, don't include any amounts you receive for your disability as income on your tax return.

Understand the income tax benefits on life insurance policies under section 80c and section 10d of income tax act 1961.

To know more about section 80c and section 10d, visit now!

Life insurance helps you to save taxes in number of ways.

If you have ever wondered you can avail tax benefits on premiums paid for a life insurance policy.

Tax deduction under section 80c of the income tax act, 1961, allows exemption up to rs.1.5 lakh per.

The insurer issues the death benefit in installments.

If you want to get out of a life insurance policy and buy another one, you may be better off trading it as part of a 1035 exchange — a provision in the u.s.

The tax benefits of life insurance are well documented and were even held up in the early 1980's.

Life insurance payments to a spouse typically aren't subject to federal income taxes or estate taxes.

If you sell your life insurance policy, the buyer will pay the premiums and receive the cash benefit upon your death.

The money you get from selling your policy may be taxed.

Life insurance policy and tax benefits under section 80 c, exemption under 10 d.

If you have paid an insurance premium to insure your own life or the life of your spouse or child, such premium payments are eligible for deduction under section 80c of the income tax act.

Generally, life insurance premiums are not tax deductible.

This is where it really gets good

Life insurance policies can carry a host of tax consequences for policyholders and beneficiaries that can easily catch you by surprise.

Bearing that in the mind, your life insurance policy may entail the following tax benefits.

Icici prudential life insurance company limited expressly disclaims any liability to any person, if tax benefits stated above are denied to the customer.

Generally speaking, a beneficiary to a life insurance policy does not pay federal income tax on the death benefit.

There are two exceptions to this rule:

Income tax benefits may be available as per the prevailing income tax laws, subject to fulfilment of conditions stipulated therein.

Tata aia life insurance company ltd.

Does not assume responsibility on tax implication mentioned anywhere in this document.

So let us summarize them for a better understanding.

It is commonly known fact and widely utilized tool that life insurance is a best tax saving option.

But only few know about the tax implications of maturity, surrender or.

How does the irs tax life insurance proceeds?

Most people who buy life insurance pay for it in a series of premiums.

When the policyholder dies, the beneficiaries receive the death benefit in a lump sum.

Our guide to life insurance tax outlines how to get tax free life insurance and compare quotes.

Who benefits from a life insurance policy in the uk?

Someone who receives a life insurance payout is known as a beneficiary.

No, life insurance benefits are, for the most part, not taxable unless the actual amount the beneficiary receives is more than what the policy states.

One important consideration to remember is that just because life insurance death benefits are almost always federal income tax free the death benefit.

Life insurance for tax benefits.

That being said, life insurance, in general, doesn't come under the strict radar of taxation, at least when compared to other financial instruments.

There are certain exemptions and tax benefits one can take advantage of if the circumstance and situation allow it.

These payouts are comprised of taxed contributions the life insured has made to their super fund.

It also allow you tax exemption in respect of the life insurance policy.

Under section 80c of income tax act, you can claim deduction for life insurance premium (lip) paid by you upto rs.

1.50 lakhs in a year along with.

So that rules out everything except income protection insurance.

Are life insurance benefits taxed in australia?

Are life insurance benefits taxed in australia? Life Insurance Benefits Taxed. The type of life insurance you have, how you bought it, and even who the beneficiary is.

Comments

Post a Comment