Life Insurance Benefits Uk Who Should Be The Beneficiary Of My Life Insurance?

Life Insurance Benefits Uk. Get An Affordable Life Insurance Policy.

SELAMAT MEMBACA!

Hsbc life insurance offers you peace of mind, knowing your loved ones are financially protected if the unexpected happens.

Choose between benefits that pay while you are unable to work for up to 2 years, or continue to your.

Life insurance helps give your family financial protection should you pass away within the policy term (98.6% of 2019 life claims paid).

Not sure how much cover you need?

1 aviva uk individual claims report 2021.

Life insurance is a way that you can protect them from what the world might have in store.

We can't promise that you won't worry, it's life insurance doesn't have to be scary.

At smart, we can offer.

Life insurance protects the most important people in your life.

Life insurance protects the most important people in your life.

Life insurance can be a great way of protecting and providing for your loved ones if you pass away.

Who should be the beneficiary of my life insurance?

Beneficiary rules in the uk.

Best health insurance uk best life insurance companies private medical treatment costs health insurance renewal switch health insurance save money on in this guide to the best life insurance companies, we've reviewed the latest independent information to bring you our list of the best in the uk.

We'd like to set additional cookies to understand how you use gov.uk, remember your settings and improve government services.

Who are the best uk relevant life insurance providers in 2021?

Uk life insurance services, offering instant comparative online life insurance quotes and information for term life insurance, mortgage protection and family income benefit.

Life insurance gives you the peace of mind that, should you pass away, your family is taken care of.

The last thing they will need upon your passing is whether a payout is used to make up for your lost income or to pay off any financial commitments you might leave behind, life insurance supports your.

Get an affordable life insurance policy.

Joint life insurance for partners.

Those in a relationship are able to take out a joint policy that will pay out • increasing term:

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

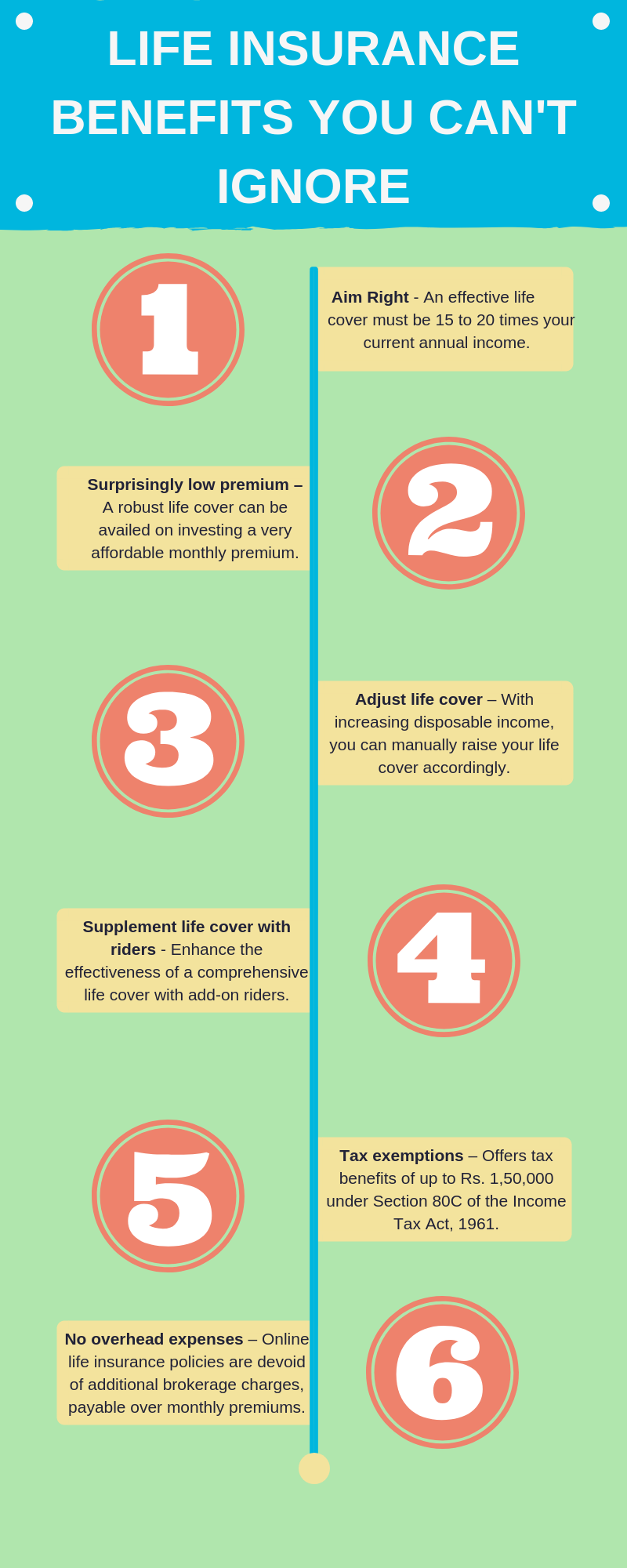

Benefits of universal life insurance.

How can i find affordable insurance?

Amount of life insurance benefits paid on domestic market in the united kingdom (uk) from 2004 to 2018 (in billion euros).

Learn about the several life insurance option to receive guaranteed income from 2nd year onwards2.

Life insurance cover4 for financial security of your family.

What is convertible life insurance?

Provide for your loved ones in a time of need.

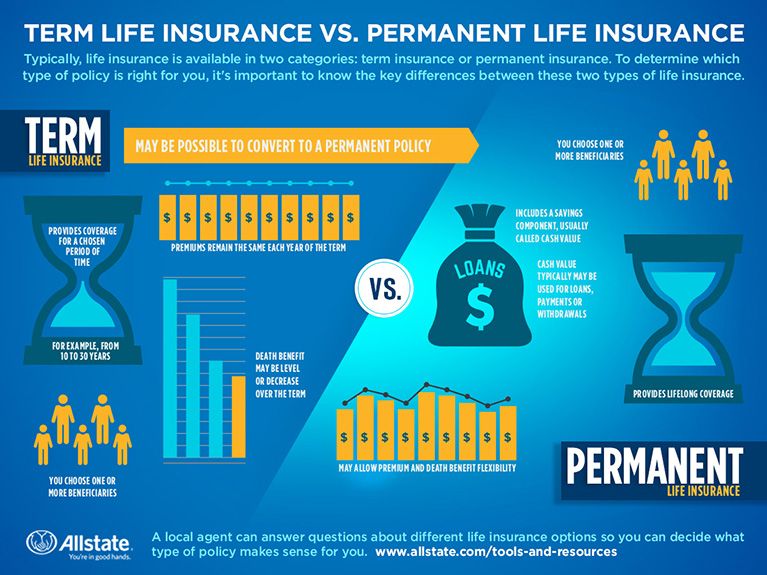

You want to make sure your family is taken care of, but term life insurance provides affordable protection for a specific period of time, usually during your working years.

What is universal life insurance?

Our policies contain exclusions, limitations, reductions in benefits, and terms for keeping them in force.

We can provide you with costs and complete details.

Michael phinn personally handled my account and was especially responsive to my needs.

I was equally impressed with the low cost of my insurance policy.

Family life insurance is simply a way of describing life insurance taken out to protect your loved ones' financial security if you were no longer around.

There are various policy options.

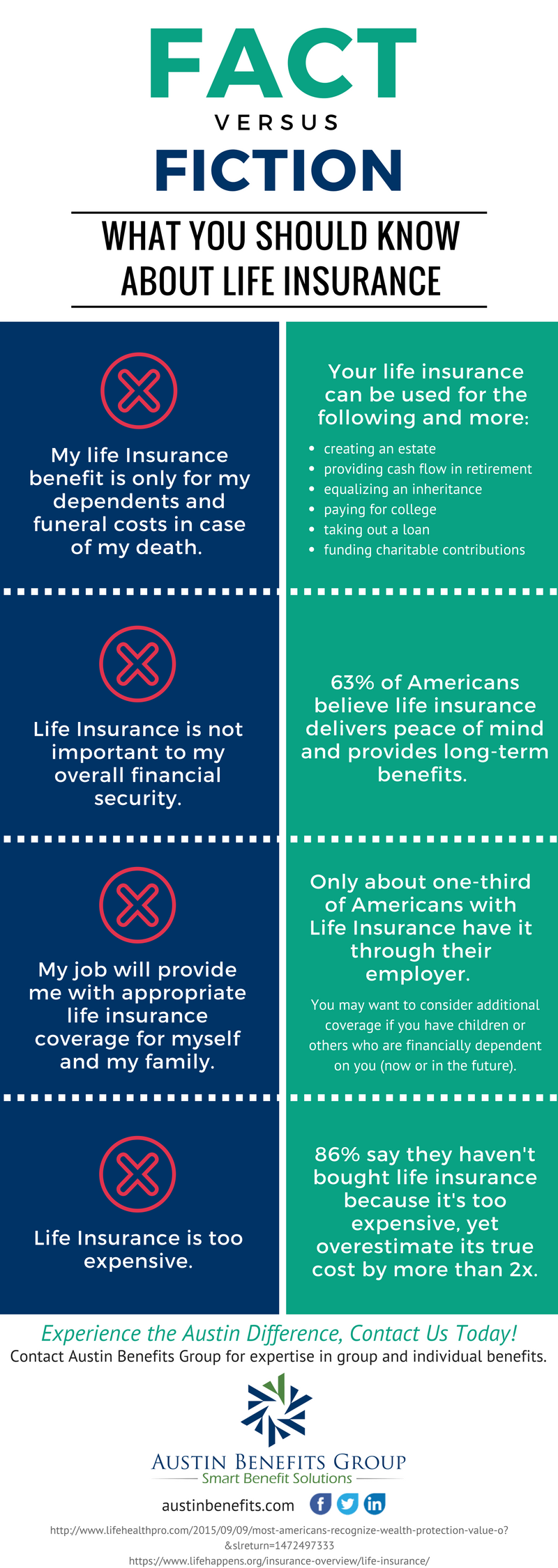

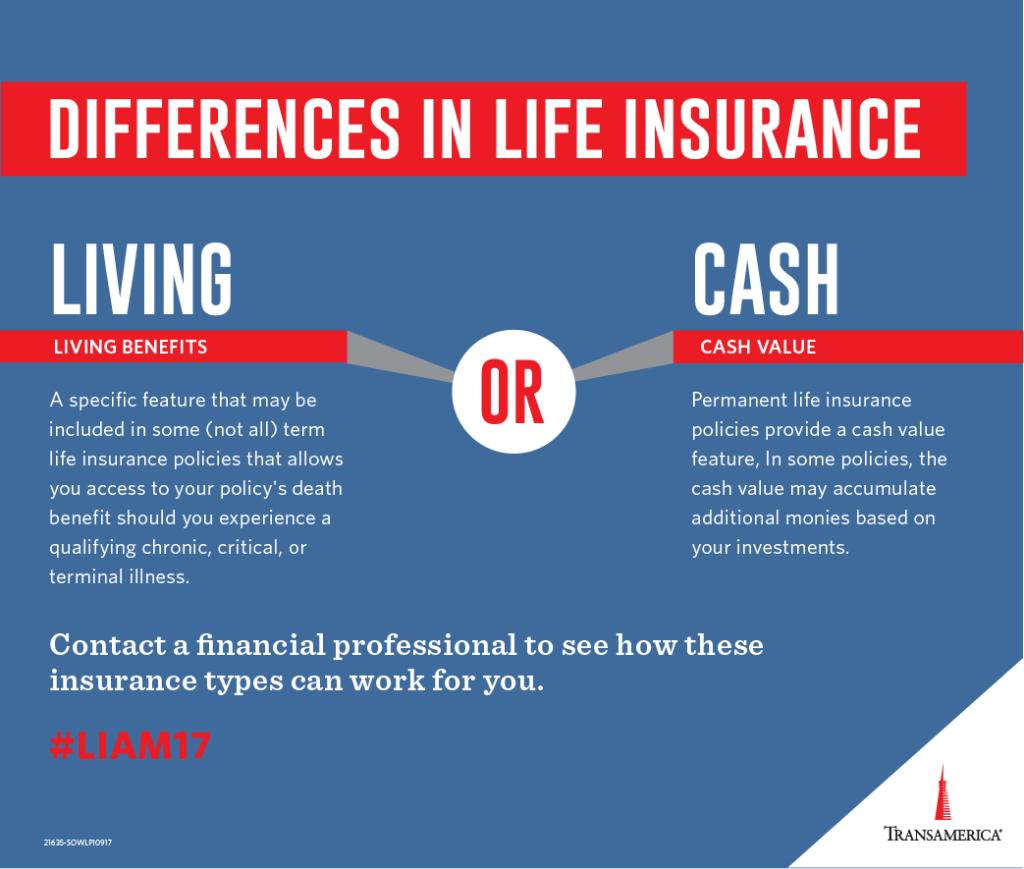

However, sometimes traditional life insurance does not cover all financial burdens, especially while the policyholder is living.

Here, we'll discuss life insurance with living benefits in 2021.

Gerber life whole life insurance provides financial protection for you and for your family when you're no longer here.

Adults aged 18 to 70 may you work too hard to be blindsided by an unanticipated event.

Whole life insurance benefits can provide financial coverage throughout the course of your life.

Discover more and get a quote today.

Life insurance support & claims.

Uk & european breakdown and recovery assistance.

Icici bank offers a range of life insurance policies & plans to suit your insurance tax benefits can be availed of only if you pay premiums regularly.

What happens when my life as your life insurance policy matures at the end of the policy term, all the maturity benefits of the policy.

Let's discuss each of these tax benefits of a life insurance policy in detail.

But what are life insurance living benefits?

This article explains what they are and how they work.

Segala Penyakit, Rebusan Ciplukan ObatnyaCara Baca Tanggal Kadaluarsa Produk MakananTernyata Tidur Bisa Buat MeninggalTernyata Ini Beda Basil Dan Kemangi!!Ternyata Madu Atasi InsomniaSehat Sekejap Dengan Es BatuSaatnya Bersih-Bersih Usus3 X Seminggu Makan Ikan, Penyakit Kronis MinggatPD Hancur Gegara Bau Badan, Ini Solusinya!!Cegah Celaka, Waspada Bahaya Sindrom HipersomniaThis article explains what they are and how they work. Life Insurance Benefits Uk. The death benefit of a life insurance policy is the amount your loved ones (or others you designate) will receive from the insurance company upon your death.

We'd like to set additional cookies to understand how you use gov.uk, remember your settings and improve government services.

Insurance companies settle a definite sum to the clients when the maturity tenure is complete.

The perquisite of getting the claimed amounts is a thorough continuation of the policy and the completion of the term under the.

How can you keep benefiting after maturity of life insurance policy?

No life insurance company assures high maturity in any savings plans or whole life plans, because the insurance companies net interest earnings is life insurance plans should not be taken for the maturity benefits!

Insurance is a concept of pooling the risks.

A customer pays the premium in lieu.

A dated mature life policy certainly offers more investment opportunities with endowment effects.

However, many life insurance policies have also become investment opportunities as well.

This is where life insurance maturity plays a role as.

Other factors that may impact.

Unlike other forms of life insurance, proceeds from family income benefit are not subject to tax.

The average life insurance cost in the uk varies depending…

As your life insurance policy matures at the end of the policy term, all the maturity benefits of the policy, if any, will be paid off and the cover will cease.

When a life insurance policy is encashed before its maturity i.e surrendered, the insured person receives a lump sum amount.

This lump sum value consists of deposited premium and interest on those deposits.

Learn about the several life insurance traditional savings plan.

Life cover to secure the future of your loved ones.

Guaranteed additions for staying invested.

Moreover, it also gives several tax benefits for the maturity amount which is received back from the life insurance company.

Any maturity amount of life insurance policy or bonus amount received by the beneficiary of the policy in case of demise of the insured is totally exempted from tax deduction.

In fact, in order to ensure compliance, if the maturity proceeds exceed rs.1 lakh, then a tax deduction at source (tds).

Our rewards programme gives you access to exclusive offers and discounts with some of the uk's leading brands, keeping you happy as well as healthy.

Life insurance support & claims.

Flexaccount travel insurance isn't available to new members anymore.

£10 million per insured person.

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

Loans that remain unpaid when the policy lapses or is surrendered while the insured is alive will be taxed immediately to the extent of gain in the policy.

Living benefits that can be added to a term life insurance policy allow the policyholder to access their financial relief in times of a chronic or catastrophic illness.

Life insurance policies can be used as tax planning tool as premium paid on insurance policies is eligible for tax benefits under section 80c of the income tax act 1961 (act) and maturity proceeds are also eligible for exemption under section section 10(10d) and section 10(10a)(iii).

Third, check whether the life insurance plan has a maturity benefit payable even after death of the policyholder or not.

Can i gift her a life insurance policy where i pay the amount once and she gets the maturity amount?

Maturity benefits for different term life insurance plans.

Choose a life insurance policy with the best maturity benefit will offer you and your loved ones financial tax benefits:

Purchasing life insurance seems daunting, but it doesn't have to be.

Learn more about options and how to find the best plan for you and your family.

If the insured person survives to the maturity date, the policy usually pays either the death benefit or the cash value directly to the insured.

Life insurance taxation faq on tax benefit on premium goods and services tax rates on life insurance policy if life insurance policy is terminated within a period of two years from the commencement of.

Life insurance plans comes with many benefits & features, know everything about life insurance & buy online.

If the insured is alive till the end of the policy term, the sum assured is payable on maturity when the policy term is completed based on type of a life insurance product.

If you have paid an insurance premium to insure your own life or the life of your spouse or child, such premium therefore, the insurance maturity proceeds are taxable, and not entitled to exemption under section.

Life insurance that covers an insured's whole life with level premiums paid over a limited time is called adjustable life renewable term limited pay life f needs life insurance that provides coverage for only a limited amount of time with a death benefit that changes regularly according to a schedule.

Life insurance are protection plans of insurance companies in which the person pays annual premium to buy the plan in which he is eligible to get a fixed amount in the event of death or maturity of the policy, whichever is earlier.

There are ample benefits of life insurance which you can reap with smart planning.

The section 80c of the act defines that the total premium paid during the tenure of.

There are ample benefits of life insurance which you can reap with smart planning. Life Insurance Benefits Uk. The section 80c of the act defines that the total premium paid during the tenure of.Nikmat Kulit Ayam, Bikin SengsaraSejarah Gudeg JogyakartaResep Garlic Bread Ala CeritaKuliner Buat Sendiri Minuman Detoxmu!!Resep Kreasi Potato Wedges Anti GagalSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatIkan Tongkol Bikin Gatal? Ini PenjelasannyaSusu Penyebab Jerawat???Resep Ayam Suwir Pedas Ala CeritaKulinerPete, Obat Alternatif Diabetes

Comments

Post a Comment