Life Insurance Benefits Meaning It Can Also Be Used To Pay Off Debt, Such As Credit Card Bills Or An Outstanding Car Loan.

Life Insurance Benefits Meaning. Permanent Life Insurance Cash Values Are Guaranteed, Meaning You Will Always Have Access To The Assets You Accumulate.

SELAMAT MEMBACA!

All life insurance can give you financial confidence that your family will have financial stability in your absence.

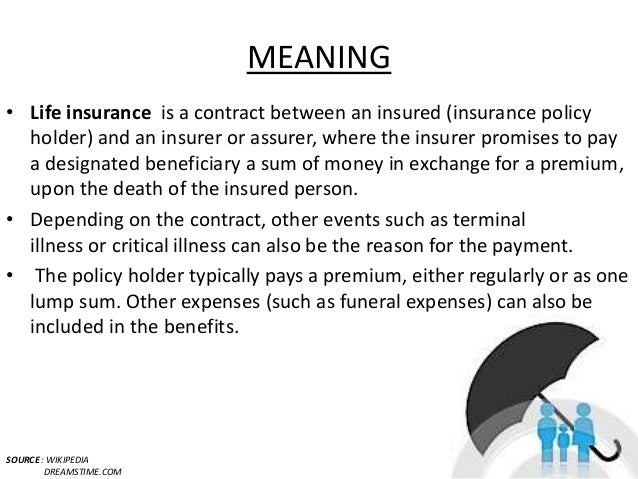

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Benefits of life insurance for individuals.

Life insurance has several benefits, especially for people who have family members or other dependents who rely on them financially.

Both the death benefit and premium are fixed.

Because actuaries must account for the increasing costs of insurance over the life of the policy's effectiveness, the premium.

Enjoy policy benefits till 99 years of age with whole life policy term option withdraw money regularly from your policy with swp3

What do we mean by that?

We strongly believe that life insurance with living benefits is worth it.

Obviously, there is never one.

Did you know that life insurance offers benefits while you're still living?

You may have a decent understanding of the benefits of life insurance, like how it can help financially protect your loved ones in the event you were to pass.

Yes, life insurance can offer the advantages of both death benefits and living benefits.

The benefits of universal life insurance include:

Indexed universal, variable universal, guaranteed universal, and regular ol' universal each provide a different way to handle your cash value.

You can adjust your premiums and death benefit on the fly as your needs change.

Loans that remain unpaid when the policy lapses or is surrendered while the insured is alive will be taxed immediately to the extent of gain in the policy.

People purchase life insurance in order to provide security for family members if they die.

All life insurance policies come with what is known as a death benefit.

Recently there has been an uptick in the number of companies that are offering policy benefits that would pay out while you are still living.

Basic life insurance concepts can be confusing and misunderstood.

In life insurance 101, learn about the types of life insurance and other essential basics.

Life insurance protects your family from a loss of income in the event of your death.

If you die, the person you designate as the receiver of the benefits this means if you (or a family member) become terminally ill, you may be able to collect the full life insurance benefit amount prior to death.

Term life insurance policies are still a great option with many advantages.

Greatest death benefit for lowest premium outlayterm life insurance however, this does not mean that term insurance is necessarily the least expensive form of insurance over the full.

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

Life insurance death benefits can be divided among your beneficiaries in any way you see fit (although it is important to discuss these options with a financial advisor).

Typically, this means that while they can still receive a death benefit, they may be required to pay tax on these benefits.

Guaranteed issue life insurance includes living benefits, which are benefits paid when the policyholder experiences a chronic or terminal illness.

Choose a beneficiary you want to help, or an organization that has meaning.

Hdfc life insurance company limited.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium this means that we have to build a solid corpus during our active life to maintain our life style for the long post retirement life if we are to enjoy the true meaning.

Some life insurance companies offer additional protection above and beyond death benefits.

These extra features (called riders) can add to the usefulness of it's also a simplified life insurance policy, meaning you won't have to take a medical exam.

Just answer several medical questions on the.

Once a life insurance claim has been submitted, the insurer will review it and pay the death benefit, so long as there are no issues with the submission.

Permanent life insurance cash values are guaranteed, meaning you will always have access to the assets you accumulate.

With so many unique benefits, permanent life insurance can be a strong addition to your balance sheet and the foundation for your financial security.

Life insurance policy provides tax benefits to the insured person, as per section 80c of the income tax act.

As per this insurance plan, the accumulated funds through the premiums are collected as the insured's asset, the benefit of which is distributed regularly to the.

To claim life insurance benefits, the beneficiary should contact the insurance company's local agent or check the company's website.

Many employees do not have access to whole life insurance maintains constant premiums and benefits.

These policies can last through retirement and build cash value over time, which.

The purpose of having life insurance is to help loved ones cope with the loss.

Plus, offering group life insurance enhances your benefits package.

And great employee benefits can help you attract and keep quality employees.

Jam Piket Organ Tubuh (Lambung) Bagian 25 Khasiat Buah Tin, Sudah Teruji Klinis!!Ternyata Menikmati Alam Bebas Ada Manfaatnya4 Manfaat Minum Jus Tomat Sebelum TidurTernyata Merokok + Kopi Menyebabkan KematianManfaat Kunyah Makanan 33 KaliIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatHindari Makanan Dan Minuman Ini Kala Perut KosongJam Piket Organ Tubuh (Paru-Paru)Ini Cara Benar Cegah HipersomniaAnd great employee benefits can help you attract and keep quality employees. Life Insurance Benefits Meaning. Best of all, your employees have guaranteed coverage—meaning they can get up to a certain amount of life insurance without answering medical.

All life insurance can give you financial confidence that your family will have financial stability in your absence.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Benefits of life insurance for individuals.

Life insurance has several benefits, especially for people who have family members or other dependents who rely on them financially.

Both the death benefit and premium are fixed.

Because actuaries must account for the increasing costs of insurance over the life of the policy's effectiveness, the premium.

Enjoy policy benefits till 99 years of age with whole life policy term option withdraw money regularly from your policy with swp3

What do we mean by that?

We strongly believe that life insurance with living benefits is worth it.

Obviously, there is never one.

Did you know that life insurance offers benefits while you're still living?

You may have a decent understanding of the benefits of life insurance, like how it can help financially protect your loved ones in the event you were to pass.

Yes, life insurance can offer the advantages of both death benefits and living benefits.

The benefits of universal life insurance include:

Indexed universal, variable universal, guaranteed universal, and regular ol' universal each provide a different way to handle your cash value.

You can adjust your premiums and death benefit on the fly as your needs change.

Loans that remain unpaid when the policy lapses or is surrendered while the insured is alive will be taxed immediately to the extent of gain in the policy.

People purchase life insurance in order to provide security for family members if they die.

All life insurance policies come with what is known as a death benefit.

Recently there has been an uptick in the number of companies that are offering policy benefits that would pay out while you are still living.

Basic life insurance concepts can be confusing and misunderstood.

In life insurance 101, learn about the types of life insurance and other essential basics.

Life insurance protects your family from a loss of income in the event of your death.

If you die, the person you designate as the receiver of the benefits this means if you (or a family member) become terminally ill, you may be able to collect the full life insurance benefit amount prior to death.

Term life insurance policies are still a great option with many advantages.

Greatest death benefit for lowest premium outlayterm life insurance however, this does not mean that term insurance is necessarily the least expensive form of insurance over the full.

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children.

Life insurance death benefits can be divided among your beneficiaries in any way you see fit (although it is important to discuss these options with a financial advisor).

Typically, this means that while they can still receive a death benefit, they may be required to pay tax on these benefits.

Guaranteed issue life insurance includes living benefits, which are benefits paid when the policyholder experiences a chronic or terminal illness.

Choose a beneficiary you want to help, or an organization that has meaning.

Hdfc life insurance company limited.

Maturity benefits of most insurance policies are tax free under section 10 (10d) and the premium this means that we have to build a solid corpus during our active life to maintain our life style for the long post retirement life if we are to enjoy the true meaning.

Some life insurance companies offer additional protection above and beyond death benefits.

These extra features (called riders) can add to the usefulness of it's also a simplified life insurance policy, meaning you won't have to take a medical exam.

Just answer several medical questions on the.

Once a life insurance claim has been submitted, the insurer will review it and pay the death benefit, so long as there are no issues with the submission.

Permanent life insurance cash values are guaranteed, meaning you will always have access to the assets you accumulate.

With so many unique benefits, permanent life insurance can be a strong addition to your balance sheet and the foundation for your financial security.

Life insurance policy provides tax benefits to the insured person, as per section 80c of the income tax act.

As per this insurance plan, the accumulated funds through the premiums are collected as the insured's asset, the benefit of which is distributed regularly to the.

To claim life insurance benefits, the beneficiary should contact the insurance company's local agent or check the company's website.

Many employees do not have access to whole life insurance maintains constant premiums and benefits.

These policies can last through retirement and build cash value over time, which.

The purpose of having life insurance is to help loved ones cope with the loss.

Plus, offering group life insurance enhances your benefits package.

And great employee benefits can help you attract and keep quality employees.

And great employee benefits can help you attract and keep quality employees. Life Insurance Benefits Meaning. Best of all, your employees have guaranteed coverage—meaning they can get up to a certain amount of life insurance without answering medical.Buat Sendiri Minuman Detoxmu!!Black Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi Luwak3 Jenis Daging Bahan Bakso TerbaikSejarah Kedelai Menjadi TahuNikmat Kulit Ayam, Bikin SengsaraAmpas Kopi Jangan Buang! Ini ManfaatnyaStop Merendam Teh Celup Terlalu Lama!9 Jenis-Jenis Kurma TerfavoritBir Pletok, Bir Halal Betawi3 Cara Pengawetan Cabai

Comments

Post a Comment