Life Insurance Benefits Uk Quotes Start From £7/month, That's Only 23p A Day.

Life Insurance Benefits Uk. We Provide An Life Insurance Uk.

SELAMAT MEMBACA!

Hsbc life insurance offers you peace of mind, knowing your loved ones are financially protected if the unexpected happens.

Life cover is underwritten by hsbc life (uk) ltd.

Get a personalised quotation and apply.

Life insurance helps give your family financial protection should you pass away within the policy term (98.6% of 2019 life claims paid).

Calls to 0800 numbers from uk landlines and mobiles are free.

1 aviva uk individual claims report 2021.

Life insurance protects the most important people in your life.

It acts as a safety net for those dependant on you if you pass away, ensuring that they don't have to worry about finances during what is already likely to be an extremely.

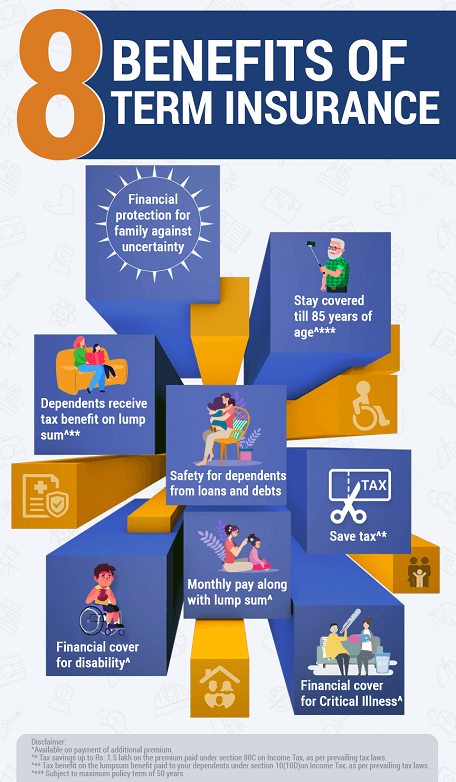

The many benefits of having life insurance.

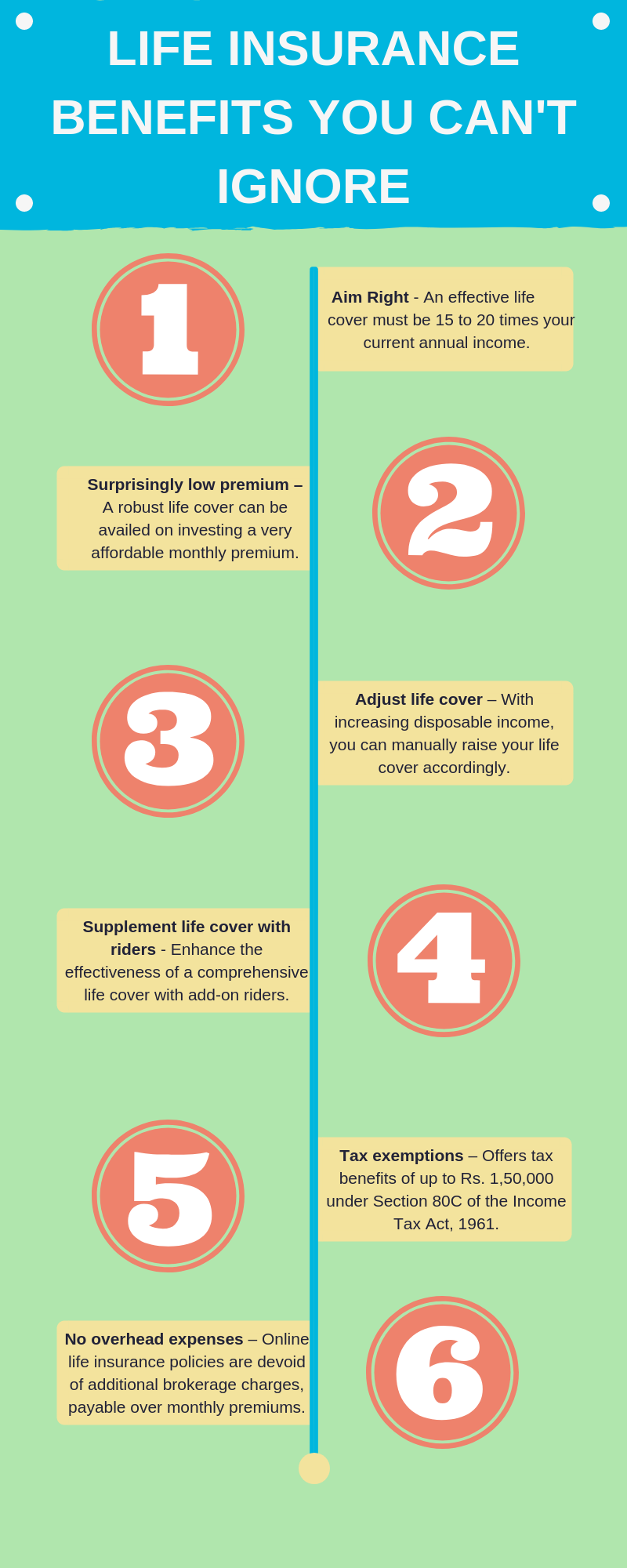

All life insurance can give you financial confidence that your family will have financial stability in your but generally, the more life insurance you have, the more benefits it will provide to your family when needed.

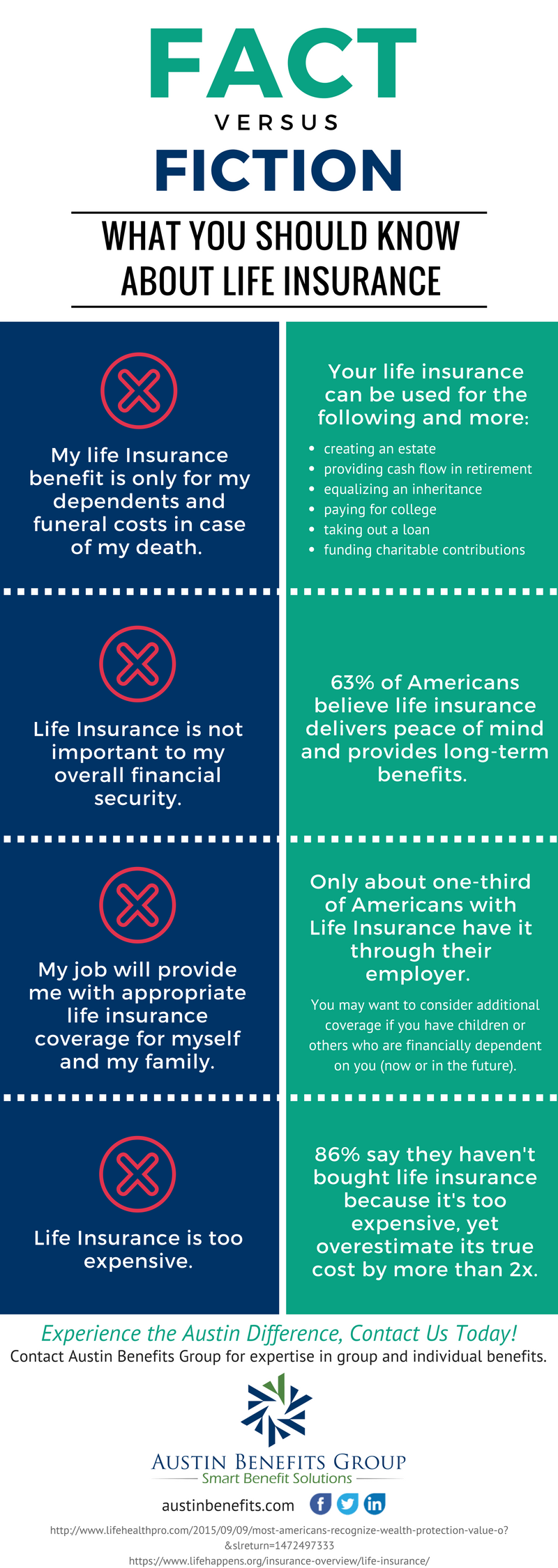

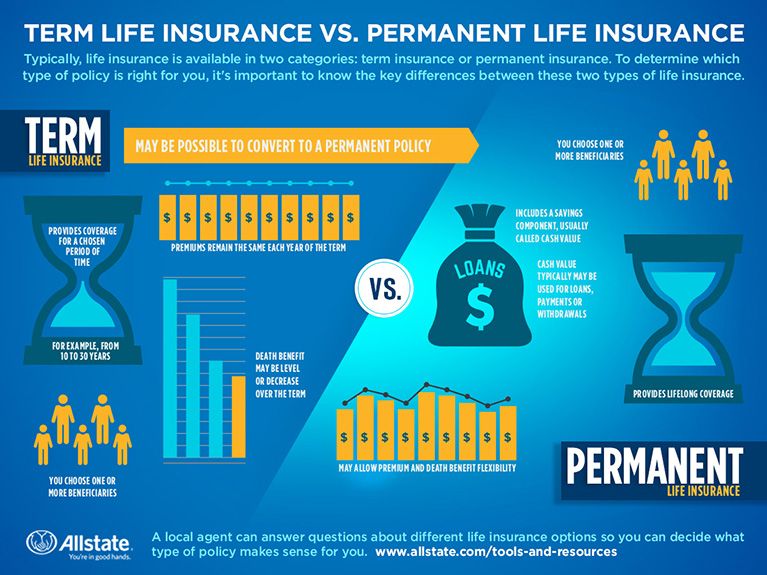

A life insurance policy is a contract with an insurance company.

Benefits of universal life insurance.

How can i find affordable insurance?

We'd like to set additional cookies to understand how you use gov.uk, remember your settings and improve government services.

Life insurance is a brilliant way to financially protect your loved ones whilst giving you peace of mind.

However, many put off getting it, thinking that they do not require it or find it too confusing.

Consider the amount of state benefits and your monthly expenses before taking out income protection insurance.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Best health insurance uk best life insurance companies private medical treatment costs health insurance renewal switch health insurance save money on in this guide to the best life insurance companies, we've reviewed the latest independent information to bring you our list of the best in the uk.

We're independent insurance advisers and have access to every uk insurer.

It is difficult to say whether there is a standout provider as it.

Get an affordable life insurance policy.

Those in a relationship are able to take out a joint policy that will pay out • increasing term:

The amount covered will increase over the duration of the policy's term, this is to match inflation so your family can get the most benefit from.

Life insurance quotes from the leading uk life insurance companies.

Amount of life insurance benefits paid on domestic market in the united kingdom (uk) from 2004 to 2018 (in billion euros).

If you've got kids, or a partner or relative relies on you for financial support, it could be worth getting though, so this guide will help you decide.

With smart family life insurance you can choose a benefit level to fit your needs and budget, depending on your age:

Our policies contain exclusions, limitations, reductions in benefits, and terms for keeping them in force.

We can provide you with costs and complete details.

Life insurance can help you plan for the future & keep your loved ones financially secure.

We offer affordable life insurance uk wide and critical illness cover from a variety of the uk's leading insurance providers, meaning you aren't compromising on quality, just.

I would gladly recommend life insurance uk.to my friends or anyone who might be interested in buying life insurance.

Michael phinn personally handled my account and was especially responsive to my needs.

Help protect your family with life insurance to suit your needs.

Quotes start from £7/month, that's only 23p a day.

Looking after you and your loved ones is something we're good at.

Members of the armed forces, army reserve (previously known.

Learn about the several life insurance option to receive guaranteed income from 2nd year onwards2.

Life insurance cover4 for financial security of your family.

Watch our short video explaining what life insurance is, how it works and why most uk families would benefit from having it.

There are various policy options.

Provide for your loved ones in a time of need.

In some cases, coverage can be extended past your original term.

However, sometimes traditional life insurance does not cover all financial burdens, especially while the policyholder is living.

Here, we'll discuss life insurance with living benefits in 2021.

Expat life insurance for uk expatriates based overseas.

Access to the best life policies available.

For most uk residents obtaining life cover is a simple task but this is not always the case as an expat living overseas.

*uk's number one life insurance provider based on new individual life insurance sales in 2019, term & health watch over 50s fixed life insurance is designed for uk residents aged 50 to 80 who want a fixed cash sum to related information and products.

Basic life insurance concepts can be confusing and misunderstood.

In life insurance 101, learn about the types of life insurance and other essential these policies provide the basic life insurance benefit, death benefit, but they can also provide life benefits which can be used while you're still alive.

Insurance products, especially unit linked plans, provide flexibility in terms of asset allocation to suit specific risk appetites, policy durations, premium payment terms and fund switching options.

Fakta Salah Kafein Kopi3 X Seminggu Makan Ikan, Penyakit Kronis MinggatAwas, Bibit Kanker Ada Di Mobil!!Ini Efek Buruk Overdosis Minum KopiMelawan Pikun Dengan ApelAsi Lancar Berkat Pepaya MudaTips Jitu Deteksi Madu Palsu (Bagian 2)Tak Hanya Manis, Ini 5 Manfaat Buah SawoCara Baca Tanggal Kadaluarsa Produk Makanan6 Khasiat Cengkih, Yang Terakhir Bikin HebohHdfc life insurance company limited. Life Insurance Benefits Uk. Insurance products, especially unit linked plans, provide flexibility in terms of asset allocation to suit specific risk appetites, policy durations, premium payment terms and fund switching options.

Maturity benefit signifies the claim of the policyholder once the policy matures.

The perquisite of getting the claimed amounts is a thorough continuation of the policy and the completion of the term under the.

We use some essential cookies to make this website work.

We'd like to set additional cookies to understand how you use gov.uk, remember your settings and improve government services.

It is unlike a term plan that only offers death risk cover, wherein the premiums paid to an insurance.

Life insurance maturity carries benefits for policy holder.

A dated mature life policy certainly offers more investment opportunities with endowment effects.

This is where life insurance maturity plays a role as.

No life insurance company assures high maturity in any savings plans or whole life plans, because the insurance companies net interest earnings is life insurance plans should not be taken for the maturity benefits!

Insurance is a concept of pooling the risks.

The cost of your life insurance premiums varies by company, the type of policy, and term length (if applicable).

Other factors that may impact.

Any maturity amount of life insurance policy or bonus amount received by the beneficiary of the policy in case of demise of the insured is totally exempted from tax deduction.

When a life insurance policy is encashed before its maturity i.e surrendered, the insured person receives a lump sum amount.

This lump sum value consists of deposited premium and interest on those deposits.

The premium portion of surrender value will be taxable if it was claimed as a deduction.

Double accident benefit and extended permanent disability is available as an inbuilt benefit under even though it is not advisable to forego the life long insurance coverage, lic provides a facility to.

Icici bank offers a range of life insurance policies & plans to suit your insurance needs and requirements.

As your life insurance policy matures at the end of the policy term, all the maturity benefits of the policy, if any, will be paid off and the cover will cease.

Third, check whether the life insurance plan has a maturity benefit payable even after death of the policyholder or not.

> my daughter is getting married next month.

Can i gift her a life insurance policy where i pay the amount once and she gets the maturity amount?

Flexaccount travel insurance isn't available to new members anymore.

If you already have flexaccount travel insurance, there are a few things you'll need to do to travel medical assistance and other expenses.

£10 million per insured person.

Basic sum (as mentioned during the policy activation).

If the insurance policy holder has died and the legal nominees are seeking the maturity benefits, then above clauses are not applicable in that case.

There are some conditions which a life insurance for all policies purchased after 1st april, 2012 the tax benefits would apply only if the sum assured is at least 10 times the annual income.

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

Loans that remain unpaid when the policy lapses or is surrendered while the insured is alive will be taxed immediately to the extent of gain in the policy.

Put hdfc bank's life sanchay as an autopilot to your financial life & enjoy multiple benefits with guaranteed additions to ensure a dignified life of your get guaranteed additions of 8% or 9% of sum assured based on your policy term to receive maturity benefit of 220% to 325% of the sum assured.

Choose a life insurance policy with the best maturity benefit will offer you and your loved ones financial tax benefits:

A policyholder can enjoy tax benefits over the premiums paid for term life insurance plans with maturity benefits.

Here, we'll discuss life insurance with living benefits in 2021.

Living benefits that can be added to a term life depending on the policy you select, the insurance company can advance this benefit if the insured is diagnosed with a terminal illness, critical illness.

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

Aviva life insurance is a joint venture between dabur invest corp, one of the india's oldest and most aviva group is a uk based insurance group, whose association with india dates back to 1834.

Life insurance plans comes with many benefits & features, know everything about life insurance & buy online.

If the insured is alive till the end of the policy term, the sum assured is payable on maturity when the policy term is completed based on type of a life insurance product.

Having a term insurance plan is one of the most important financial decisions that you can make.

Not only it secures your family's future but it also.

On policy maturity, it pays the maturity benefits along with the accumulated bonuses.

If you want to remain insured throughout your life, whole life.

In a term life insurance policy, the life insurance protection expires whenever the selected term you chose is over.

Renewing your term life insurance if you buy a whole life insurance policy from a mutual insurance company, you may receive annual dividend payments on your policy.6 these.

A term life policy's death benefit is payable only if the insured dies during the specified period.

Basic type of life insurance that is lower in cost to a policyowner, is only in force for a specified period of time and does not accumulate cash value, nor does it provide the policyowner with any policy loan value. Life Insurance Benefits Uk. A term life policy's death benefit is payable only if the insured dies during the specified period.Kuliner Jangkrik Viral Di JepangResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangResep Selai Nanas HomemadeFoto Di Rumah Makan PadangNikmat Kulit Ayam, Bikin SengsaraTernyata Jajanan Pasar Ini Punya Arti RomantisPecel Pitik, Kuliner Sakral Suku Using BanyuwangiSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatTrik Menghilangkan Duri Ikan Bandeng9 Jenis-Jenis Kurma Terfavorit

Comments

Post a Comment