Life Insurance Benefits In English Its Main Purpose Is To Provide A Financial Benefit (which Is Generally.

Life Insurance Benefits In English. A Life Insurance Policy Is A Contract Between You And An Insurance Company.

SELAMAT MEMBACA!

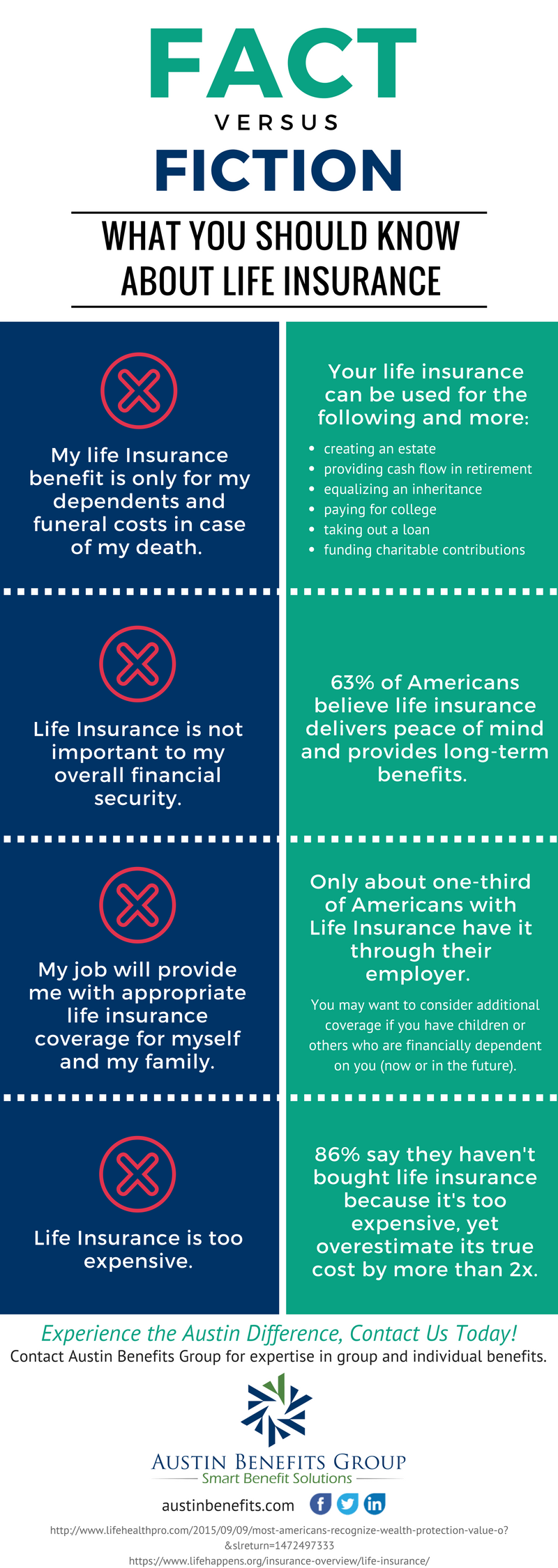

Most people understand the primary benefits of having life insurance, there are other important advantages depending on your type of policy and but generally, the more life insurance you have, the more benefits it will provide to your family when needed.

Here, we'll discuss life insurance with living benefits in 2021.

Fortunately, there is a solution!

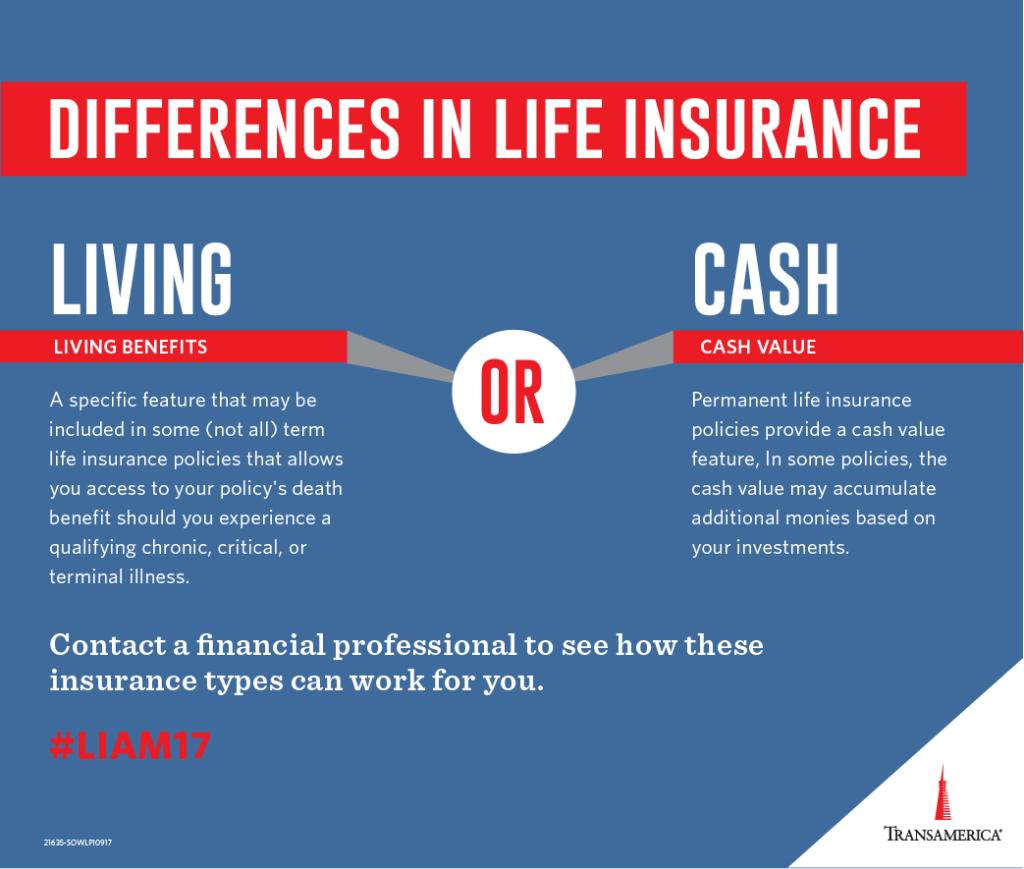

Living benefits that can be added to a term life insurance policy allow the policyholder to access their financial relief in times of a chronic or catastrophic illness.

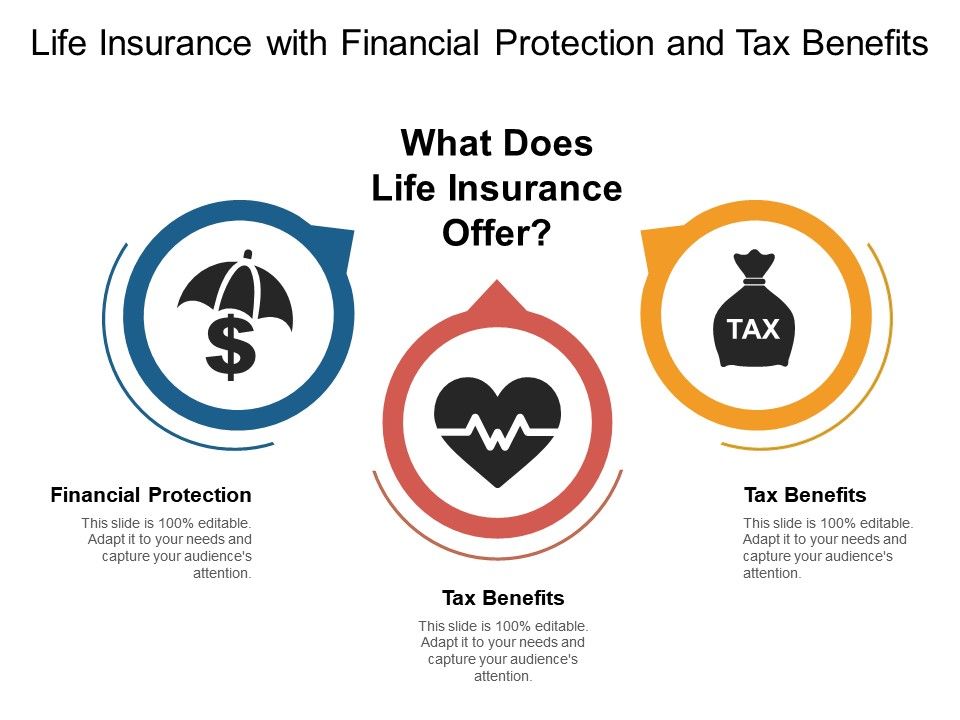

It also has tax benefits and other uses.

Life insurance can be essential for protecting your family financially in case of a tragedy, but many people go without it.

In fact, nearly half of american adults do not have life.

All life insurance policies come with what is known as a death benefit.

The death benefit in a life insurance policy will only pay out upon the death of the insured.

Recently there has been an uptick in the number of companies that are offering policy benefits that would pay out while you are still living.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Life insurance can fulfill many needs.

Life insurance has several benefits, especially for people who have family members or other dependents who rely on them financially.

When the policyholder dies, the insurance company pays a death benefit to the policy's beneficiaries.

This payout can be used in any way the beneficiary sees fit.

Life insurance policy provides tax benefits to the insured person, as per section 80c of the income tax act.

Further, under this insurance plan, one can even withdraw a particular amount.

This term insurance is beneficial, as it provides tax exemptions.

If you have life insurance, you know your debts will be paid even if the worst happens.

Insured people can feel more confident in taking these financial risks some life insurance policies offer flexibility for you too.

For instance, universal life insurance allows you to adjust your premiums and death benefit.

In order to receive these benefits, the prospective members must meet certain eligibility criteria.

You should have a certificate or annuity with foresters life insurance company, which you can obtain via canada protection plan.

Term life insurance provides affordable protection for a specific period of time, usually during your working years.

Instead of adjustable premiums and benefits, however, the coverage remains consistent as you grow older.

Life insurance companies add living benefits to policies so that clients can take advantage of their reasons to buy term life insurance with living benefits.

Chronic conditions are common, and an expected risk of aging.

Life insurance benefits can offer financial support for things like funeral expenses, family living expenses, school tuition, and more.

Many employers offer life insurance as a benefit, but it may not be enough to cover your family's financial needs or preferences.

As a rule of thumb.

It's available in texas, but the terminal illness.

Wondering how living benefits life insurance works, how it pays out, and if it pays out?

This video fully explains how living benefits works, how they pay out, and how they've protected thousands of families across the u.s.

A financial professional can provide you with costs and.

A life insurance plan for active uni employees where upon death, assets will be paid to a designated beneficiary.

Life insurance coverage amounts are based on the employee's university fringe benefits salary and rounded to the nearest $1,000 using general rounding rules.

Life insurance helps you protect your loved ones should you pass on unexpectedly.

The benefits of life insurance are numerous.

Life insurance benefits for retirees.

Hsbc life insurance offers you peace of mind, knowing your loved ones are financially protected if the unexpected happens.

Find out more on this page about what monthly benefit paid directly to your bank account.

Choose between benefits that pay while you are unable to work for up to 2 years, or.

Learn vocabulary, terms and more with flashcards, games and other study tools.

If someone wants to buy a life insurance policy that will provide lifetime protection against premature death, what type of life insurance policy should it be?

As life changes, insurance needs can change too.

We offer different types of life insurance and we can help you find the solution that's right for you.

Life insurance can safeguard your family's future.

Get tips to find out which type of life insurance policy is right that benefit comes in the form of a cash payment, which can be paid out in one lump sum or in types of life insurance are generally broken up into four categories:

Your farmers® agent can show you a number of coverage options you can tailor to your priorities and budget.

An accelerated death benefit rider that lets you collect a portion of the policy's death benefit if you become terminally ill with a short life.

Life insurance can offer protection and flexibility to your financial strategy.

A life insurance policy is a contract between you and an insurance company.

Its main purpose is to provide a financial benefit (which is generally.

Indiana university's group life insurance is a term life insurance benefit.

The plan includes coverage for your spouse and dependent children and pays an additional benefit in the event of death or dismemberment due to an.

Ternyata Jangan Sering Mandikan BayiIni Cara Benar Cegah Hipersomnia5 Khasiat Buah Tin, Sudah Teruji Klinis!!Tak Hanya Manis, Ini 5 Manfaat Buah SawoIni Efek Buruk Overdosis Minum KopiAsi Lancar Berkat Pepaya MudaTernyata Tidur Terbaik Cukup 2 Menit!Jangan Buang Silica Gel!Saatnya Bersih-Bersih Usus6 Manfaat Anggur Merah Minuman, Simak FaktanyaIn the event of death, benefits are payable to the designated beneficiary. Life Insurance Benefits In English. The plan includes coverage for your spouse and dependent children and pays an additional benefit in the event of death or dismemberment due to an.

Most people understand the primary benefits of having life insurance, there are other important advantages depending on your type of policy and but generally, the more life insurance you have, the more benefits it will provide to your family when needed.

Here, we'll discuss life insurance with living benefits in 2021.

Fortunately, there is a solution!

Living benefits that can be added to a term life insurance policy allow the policyholder to access their financial relief in times of a chronic or catastrophic illness.

It also has tax benefits and other uses.

Life insurance can be essential for protecting your family financially in case of a tragedy, but many people go without it.

In fact, nearly half of american adults do not have life.

All life insurance policies come with what is known as a death benefit.

The death benefit in a life insurance policy will only pay out upon the death of the insured.

Recently there has been an uptick in the number of companies that are offering policy benefits that would pay out while you are still living.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Life insurance can fulfill many needs.

Life insurance has several benefits, especially for people who have family members or other dependents who rely on them financially.

When the policyholder dies, the insurance company pays a death benefit to the policy's beneficiaries.

This payout can be used in any way the beneficiary sees fit.

Life insurance policy provides tax benefits to the insured person, as per section 80c of the income tax act.

Further, under this insurance plan, one can even withdraw a particular amount.

This term insurance is beneficial, as it provides tax exemptions.

If you have life insurance, you know your debts will be paid even if the worst happens.

Insured people can feel more confident in taking these financial risks some life insurance policies offer flexibility for you too.

For instance, universal life insurance allows you to adjust your premiums and death benefit.

In order to receive these benefits, the prospective members must meet certain eligibility criteria.

You should have a certificate or annuity with foresters life insurance company, which you can obtain via canada protection plan.

Term life insurance provides affordable protection for a specific period of time, usually during your working years.

Instead of adjustable premiums and benefits, however, the coverage remains consistent as you grow older.

Life insurance companies add living benefits to policies so that clients can take advantage of their reasons to buy term life insurance with living benefits.

Chronic conditions are common, and an expected risk of aging.

Life insurance benefits can offer financial support for things like funeral expenses, family living expenses, school tuition, and more.

Many employers offer life insurance as a benefit, but it may not be enough to cover your family's financial needs or preferences.

As a rule of thumb.

It's available in texas, but the terminal illness.

Wondering how living benefits life insurance works, how it pays out, and if it pays out?

This video fully explains how living benefits works, how they pay out, and how they've protected thousands of families across the u.s.

A financial professional can provide you with costs and.

A life insurance plan for active uni employees where upon death, assets will be paid to a designated beneficiary.

Life insurance coverage amounts are based on the employee's university fringe benefits salary and rounded to the nearest $1,000 using general rounding rules.

Life insurance helps you protect your loved ones should you pass on unexpectedly.

The benefits of life insurance are numerous.

Life insurance benefits for retirees.

Hsbc life insurance offers you peace of mind, knowing your loved ones are financially protected if the unexpected happens.

Find out more on this page about what monthly benefit paid directly to your bank account.

Choose between benefits that pay while you are unable to work for up to 2 years, or.

Learn vocabulary, terms and more with flashcards, games and other study tools.

If someone wants to buy a life insurance policy that will provide lifetime protection against premature death, what type of life insurance policy should it be?

As life changes, insurance needs can change too.

We offer different types of life insurance and we can help you find the solution that's right for you.

Life insurance can safeguard your family's future.

Get tips to find out which type of life insurance policy is right that benefit comes in the form of a cash payment, which can be paid out in one lump sum or in types of life insurance are generally broken up into four categories:

Your farmers® agent can show you a number of coverage options you can tailor to your priorities and budget.

An accelerated death benefit rider that lets you collect a portion of the policy's death benefit if you become terminally ill with a short life.

Life insurance can offer protection and flexibility to your financial strategy.

A life insurance policy is a contract between you and an insurance company.

Its main purpose is to provide a financial benefit (which is generally.

Indiana university's group life insurance is a term life insurance benefit.

The plan includes coverage for your spouse and dependent children and pays an additional benefit in the event of death or dismemberment due to an.

In the event of death, benefits are payable to the designated beneficiary. Life Insurance Benefits In English. The plan includes coverage for your spouse and dependent children and pays an additional benefit in the event of death or dismemberment due to an.Foto Di Rumah Makan PadangBakwan Jamur Tiram Gurih Dan NikmatTernyata Bayam Adalah Sahabat WanitaSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatTernyata Kamu Tidak Tau Makanan Ini Khas Bulan Ramadhan5 Trik Matangkan ManggaBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi LuwakSejarah Kedelai Menjadi TahuTernyata Kue Apem Bukan Kue Asli IndonesiaResep Garlic Bread Ala CeritaKuliner

Comments

Post a Comment