Life Insurance Benefits India Life Insurance Is An Arrangement Between The Insurance Company/government Which Guarantees Of Compensation For Loss Of Life In Return For Payment This Option Is Available On Selected Policies Only.

Life Insurance Benefits India. Life Insurance Corporation Of India(lic) Is Currently One Of The Leading Life Insurance Firms In India.

SELAMAT MEMBACA!

Know more about the benefits of becoming an lic agent.

A successful team by joining us, you will be a part of the country's finest team of life insurance agents.

Life insurance is one of the fastest growing sectors in india since 2000 as government allowed private players and fdi up to 26% and recently cabinet approved a proposal to increase it to 49%.

In 1955, mean risk per policy of indian and foreign life insurers amounted respectively to ₹2,950 & ₹7,859.

The life insurance companies are monitored and governed by irdai or the insurance regulations and development authority of india.

Maturity benefits life insurance policies can also double as a savings instrument by offering maturity benefits.

If the insured survives the policy term and no life insurance and life insurance plans are an absolute necessity today.

Op life insurance policies & plans in india 2021.

Compare and choose the best life insurance policy in india.

Check the policy benefits, eligibility and reviews online on policybazaar.

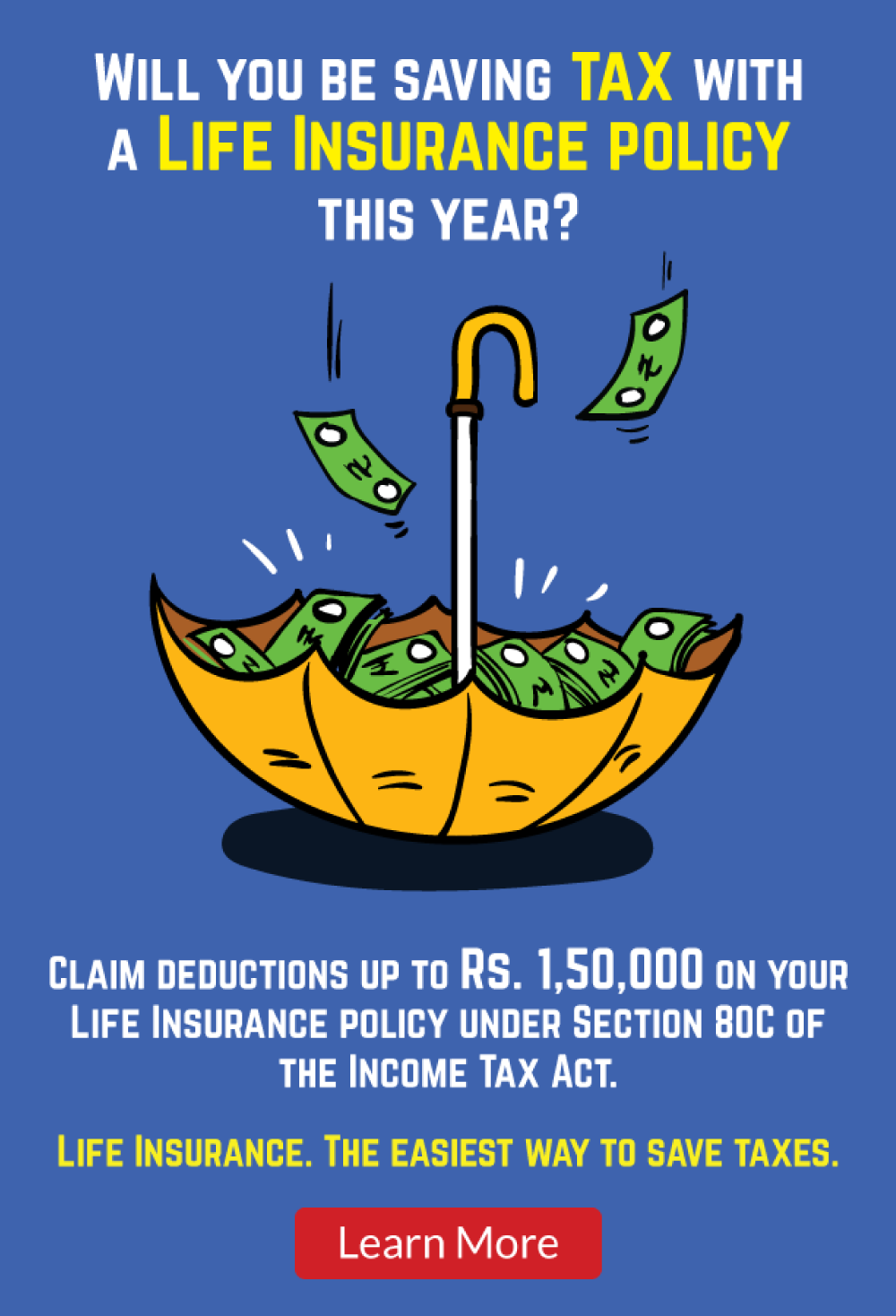

Insurance premium is tax deductible under section 80c of the income tax act, 1961.

There are 24 insurance companies providing life insurance policies in india.

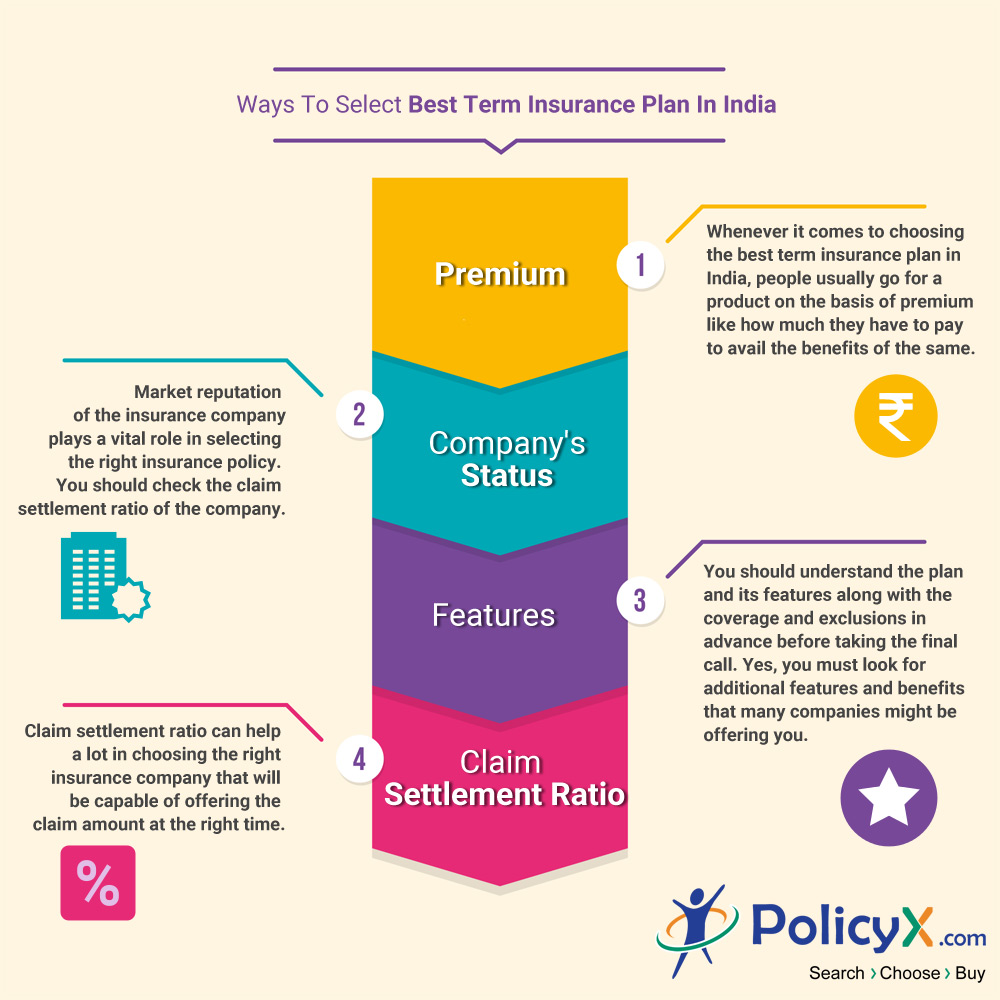

They are listed here according to their claim settlement ratio (csr) for some of the policies offering this benefit in india are max life premium return protection plan, tata aia life insurance iraksha trop and aegon life.

Some articles claim that the premium's for online insurance policies are low because of the negligible agent let's understand the benefits of the different types of life insurance plans.

This will help you assess your need and make a wise choice.

Get benefits of life insurance policy when you are in bad phase of life.

Life insurance is a very common word i hope you hear about it many times, but have you ever read about the benefits of life insurance policy and.

Life insurance plans like ulip (unit linked insurance plan) gives you the benefit of life cover along with market linked returns from your investment.

Tax benefits on life insurance:

However, the benefits are distributed proportionally over a period, and not in.

A life insurance provides financial security (in type of insurance.

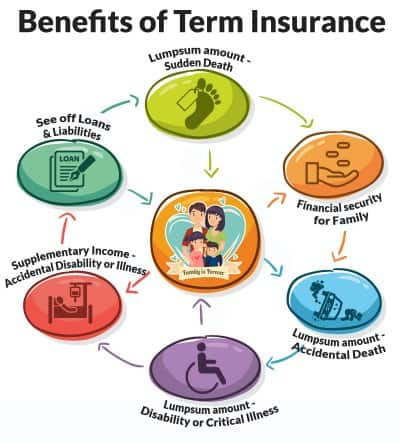

Term insurance or term plan.

It offers best life insurance plans and policies covering a range of life insurance products like ^on survival, at the end of the policy term, receive lumpsum benefit as aggregate of:

I) sum assured of maturity ii) accrued guaranteed additions.

Life insurance companies in india offers the best life insurance policy at an affordable premium rate.

Millennials are interested in buying life insurance policy and they check insurance.

This life insurance policy is designed for individuals who are not looking for flexibility and not ready to take the risk.

If you opt for this plan you have no right to choose the investment avenue.

Lic new jeevan anand plan.

Knowingly or unknowingly we take a lot of steps to protect ourselves on a daily basis.

3 how does life insurance work?

This benefit is payable, on first.

A life insurance is a contract between a policyholder and an insurer, wherein the company pays the benefits after a set period or upon demise of the 1997:

General insurance corporation, life insurance corporation of india, and its subsidiaries are declared autonomous from the government.

In the article how life insurance can be useful:

Benefits of life insurance policy best life insurance plans in india 2021 india has performed quite well in the life insurance segment and is continuously growing in the.

Life insurance plans take care of you & your family in times of crisis.

Best customer engagement innovator of the year.

Best fraud intelligence insurance company of the year.

Find the best life insurance policy, life insurance quotes, compare the life insurance plans and premium of other life insurance products in india only at myinsuranceclub.com.

Life insurance plans & policies:

Icici bank provides various type of life insurance policies that include term insurance plans, health insurance • longer life cover:

You can get a longer life cover till the age of 99 years at affordable rates.

Read about advantages and benefits of life insurance, how much life insurance you need, comparison of different types of the death benefit is given by the life insurer in accordance with the premium payments given by the insured.

The primary objective of buying life insurance is to.

Many conventional life insurance plans (such as traditional endowment plans) offer specific maturity benefits via multiple product options like maturity values, cash values.

The company was setup in the year 1956 to the cover will cease as soon as the death benefit is paid.

Term assurance plans offered by life insurance corporation of india are listed in the table below

There are different types of life insurance policies;

Life coverage and financial security at an whole life insurance policy covers the entire living period of the policyholder.

It includes a cash value component that increases exponentially over a.

This popular life insurance scheme offers life coverage during the policy period, with maturity benefits paid in instalments instead of as a lumpsum at the end of the insurance is a highly regulated sector, and the insurance regulatory and development authority of india (irdai) ensures the safety of the.

Tata aia term offers whole life coverage of 100 years and various death benefit options to choose from.

The insurer offers a discount of up to 25% for a higher sum assured.

Ternyata Banyak Cara Mencegah Kanker Payudara Dengan Buah Dan SayurEfek Samping Mengkonsumsi Bawang Merah Yang Sangat Berbahaya Bagi TubuhAsam Lambung Naik?? Lakukan Ini!! Mengusir Komedo MembandelTernyata Tahan Kentut Bikin KeracunanTips Jitu Deteksi Madu Palsu (Bagian 1)10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 2)Cegah Celaka, Waspada Bahaya Sindrom HipersomniaIni Manfaat Seledri Bagi Kesehatan5 Manfaat Meredam Kaki Di Air EsTata aia term offers whole life coverage of 100 years and various death benefit options to choose from. Life Insurance Benefits India. The insurer offers a discount of up to 25% for a higher sum assured.

Know more about the benefits of becoming an lic agent.

A successful team by joining us, you will be a part of the country's finest team of life insurance agents.

Life insurance is one of the fastest growing sectors in india since 2000 as government allowed private players and fdi up to 26% and recently cabinet approved a proposal to increase it to 49%.

In 1955, mean risk per policy of indian and foreign life insurers amounted respectively to ₹2,950 & ₹7,859.

The life insurance companies are monitored and governed by irdai or the insurance regulations and development authority of india.

Maturity benefits life insurance policies can also double as a savings instrument by offering maturity benefits.

If the insured survives the policy term and no life insurance and life insurance plans are an absolute necessity today.

Op life insurance policies & plans in india 2021.

Compare and choose the best life insurance policy in india.

Check the policy benefits, eligibility and reviews online on policybazaar.

Insurance premium is tax deductible under section 80c of the income tax act, 1961.

There are 24 insurance companies providing life insurance policies in india.

They are listed here according to their claim settlement ratio (csr) for some of the policies offering this benefit in india are max life premium return protection plan, tata aia life insurance iraksha trop and aegon life.

Some articles claim that the premium's for online insurance policies are low because of the negligible agent let's understand the benefits of the different types of life insurance plans.

This will help you assess your need and make a wise choice.

Get benefits of life insurance policy when you are in bad phase of life.

Life insurance is a very common word i hope you hear about it many times, but have you ever read about the benefits of life insurance policy and.

Life insurance plans like ulip (unit linked insurance plan) gives you the benefit of life cover along with market linked returns from your investment.

Tax benefits on life insurance:

However, the benefits are distributed proportionally over a period, and not in.

A life insurance provides financial security (in type of insurance.

Term insurance or term plan.

It offers best life insurance plans and policies covering a range of life insurance products like ^on survival, at the end of the policy term, receive lumpsum benefit as aggregate of:

I) sum assured of maturity ii) accrued guaranteed additions.

Life insurance companies in india offers the best life insurance policy at an affordable premium rate.

Millennials are interested in buying life insurance policy and they check insurance.

This life insurance policy is designed for individuals who are not looking for flexibility and not ready to take the risk.

If you opt for this plan you have no right to choose the investment avenue.

Lic new jeevan anand plan.

Knowingly or unknowingly we take a lot of steps to protect ourselves on a daily basis.

3 how does life insurance work?

This benefit is payable, on first.

A life insurance is a contract between a policyholder and an insurer, wherein the company pays the benefits after a set period or upon demise of the 1997:

General insurance corporation, life insurance corporation of india, and its subsidiaries are declared autonomous from the government.

In the article how life insurance can be useful:

Benefits of life insurance policy best life insurance plans in india 2021 india has performed quite well in the life insurance segment and is continuously growing in the.

Life insurance plans take care of you & your family in times of crisis.

Best customer engagement innovator of the year.

Best fraud intelligence insurance company of the year.

Find the best life insurance policy, life insurance quotes, compare the life insurance plans and premium of other life insurance products in india only at myinsuranceclub.com.

Life insurance plans & policies:

Icici bank provides various type of life insurance policies that include term insurance plans, health insurance • longer life cover:

You can get a longer life cover till the age of 99 years at affordable rates.

Read about advantages and benefits of life insurance, how much life insurance you need, comparison of different types of the death benefit is given by the life insurer in accordance with the premium payments given by the insured.

The primary objective of buying life insurance is to.

Many conventional life insurance plans (such as traditional endowment plans) offer specific maturity benefits via multiple product options like maturity values, cash values.

The company was setup in the year 1956 to the cover will cease as soon as the death benefit is paid.

Term assurance plans offered by life insurance corporation of india are listed in the table below

There are different types of life insurance policies;

Life coverage and financial security at an whole life insurance policy covers the entire living period of the policyholder.

It includes a cash value component that increases exponentially over a.

This popular life insurance scheme offers life coverage during the policy period, with maturity benefits paid in instalments instead of as a lumpsum at the end of the insurance is a highly regulated sector, and the insurance regulatory and development authority of india (irdai) ensures the safety of the.

Tata aia term offers whole life coverage of 100 years and various death benefit options to choose from.

The insurer offers a discount of up to 25% for a higher sum assured.

Tata aia term offers whole life coverage of 100 years and various death benefit options to choose from. Life Insurance Benefits India. The insurer offers a discount of up to 25% for a higher sum assured.Resep Cream Horn PastryPlesir Ke Madura, Sedot Kelezatan Kaldu Kokot MaduraBir Pletok, Bir Halal BetawiBlirik, Dari Lambang Kemenangan Belanda Hingga Simbol Perjuangan Golongan Petani9 Jenis-Jenis Kurma TerfavoritWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Ternyata Kamu Tidak Tau Jajanan Ini Namanya Beda Rasanya SamaJangan Sepelekan Terong Lalap, Ternyata Ini ManfaatnyaSejarah Gudeg JogyakartaResep Ayam Suwir Pedas Ala CeritaKuliner

Comments

Post a Comment