Life Insurance Benefits For Employees Especially If You Purchase It Through Your Employer.

Life Insurance Benefits For Employees. For State Group Life Insurance Premiums Review The Benefit Premiums Web Page.

SELAMAT MEMBACA!

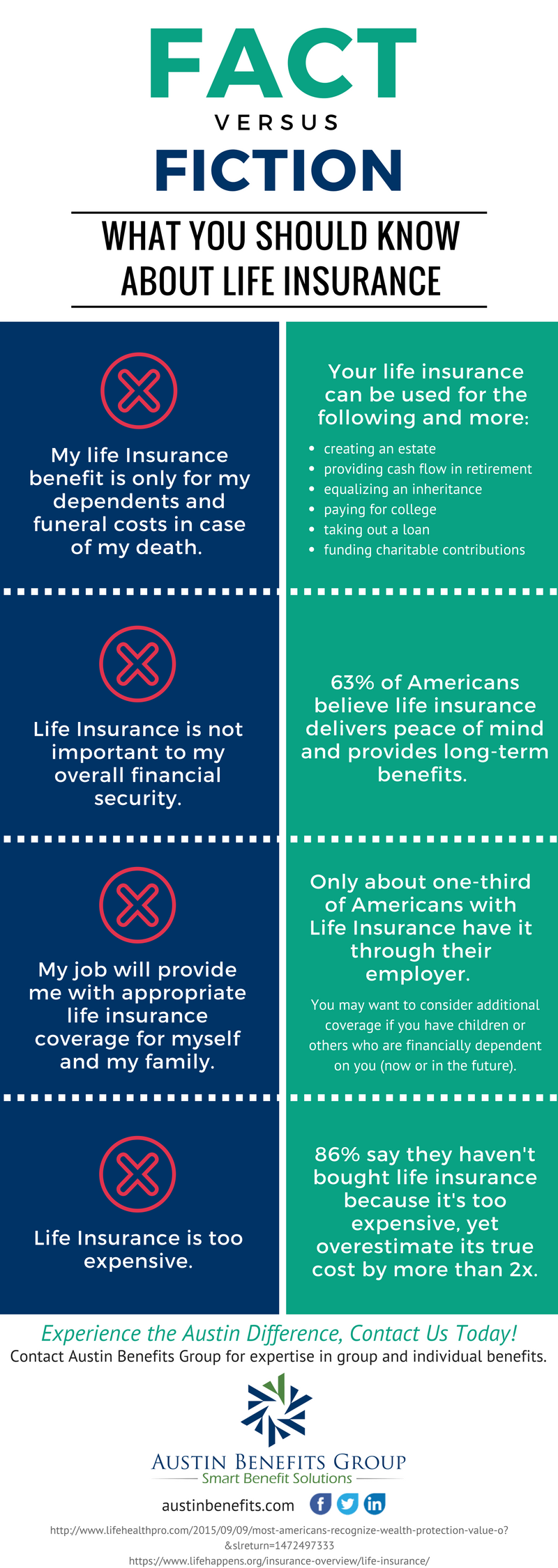

A popular employee benefit for both employers and employees is life insurance.

If you're considering including life insurance in your employee.

When employees have life insurance, it helps them financially protect their loved ones if the unthinkable should happen.

Life insurance provides a payment, also known as a death benefit, to beneficiaries after the insured person's death.

Especially employees with families like the security of the safety net that life insurance provides.

Life insurance provides peace of mind for an employee who is concerned about how his or her family, or heirs, will make out.

Benefits of offering life insurance.

We would not recommend offering variable life insurance as part of your benefits package.

An employee should get this on their own.

As part of your employee benefits package, you employer may provide some group term life insurance.

Provide for your loved ones in a time of need.

You want to make sure your family is taken instead of adjustable premiums and benefits, however, the coverage remains consistent as you grow older.

Find out more about offering individual or group life insurance for your employees.

Especially if you purchase it through your employer.

Often employers will pay the full cost of the basic term life premiums for you, as an employee benefit.

Employers may also offer additional voluntary coverage, which is paid for by the employee.

1 this policy provides limited benefits for specified diseases only.

This limited health benefit plan (1) does not constitute major medical.

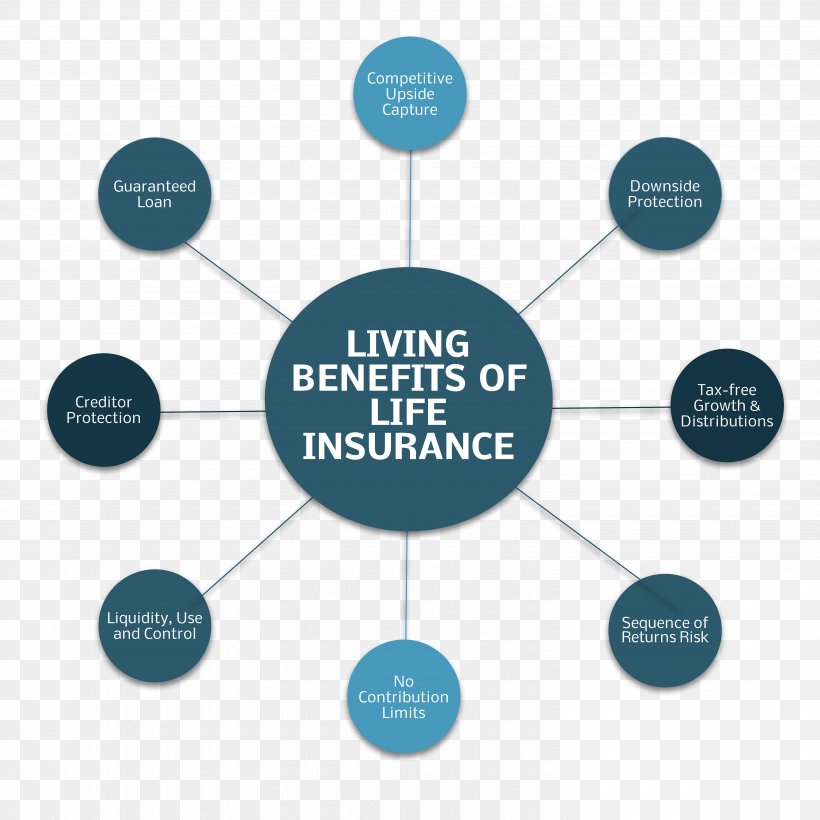

Life insurance benefits may be paid prior to death under certain circumstances.

Contact your group insurance representative (gir).

The federal government established the federal employees' group life insurance (fegli) program in 1954 to provide group term life insurance.

Fegli can help you meet your life insurance needs.

Some employers offer life insurance to their employees.

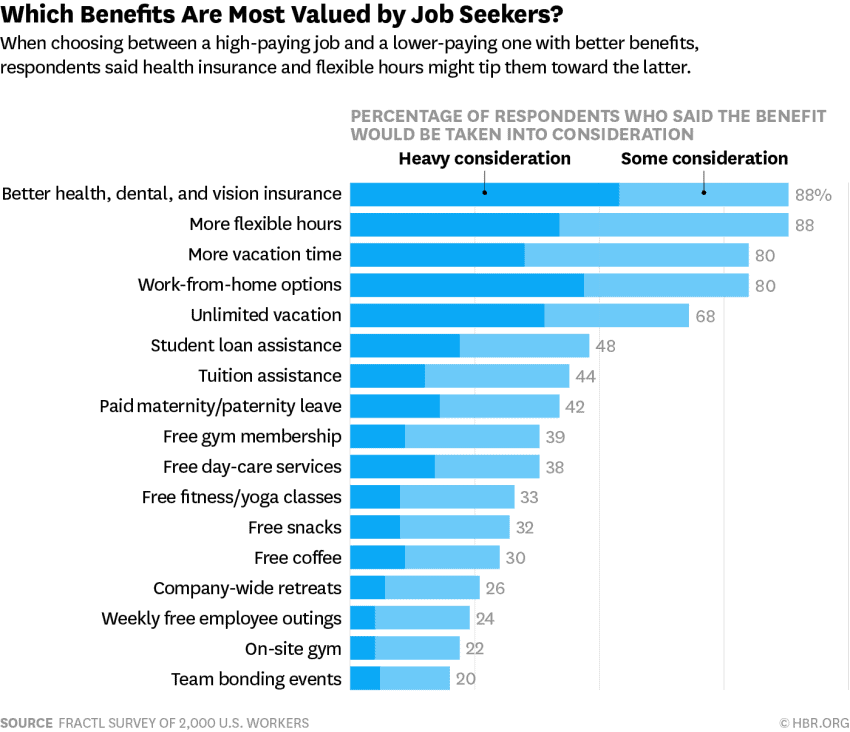

Choosing your employee benefits can be complicated.

Take the time to review your options and ask questions about anything you're unclear about.

Employee premiums are based on your highest calendar year of eligible earnings, your age as of april 1st each year and your elected coverage level(s).

The uw system contributes 65.25% of the employee.

Basic life insurance is equal to the actual rate of annual basic pay (rounded to the next $1,000) plus $2,000, or $10,000, whichever is greater.

Double life insurance benefits until age 36, decreasing at 10 percent per year until age 45.

The ncflex group term life insurance is offered to all eligible state employees through the ncflex program.

This plan provides coverage for employees, spouses and children up to age 26.

Life insurance is an important part of a comprehensive employee benefits package that helps support employees' financial wellness.

After all, a path toward enhanced financial independence involves more than just building savings.

Employees often protect the things that are valuable to them.

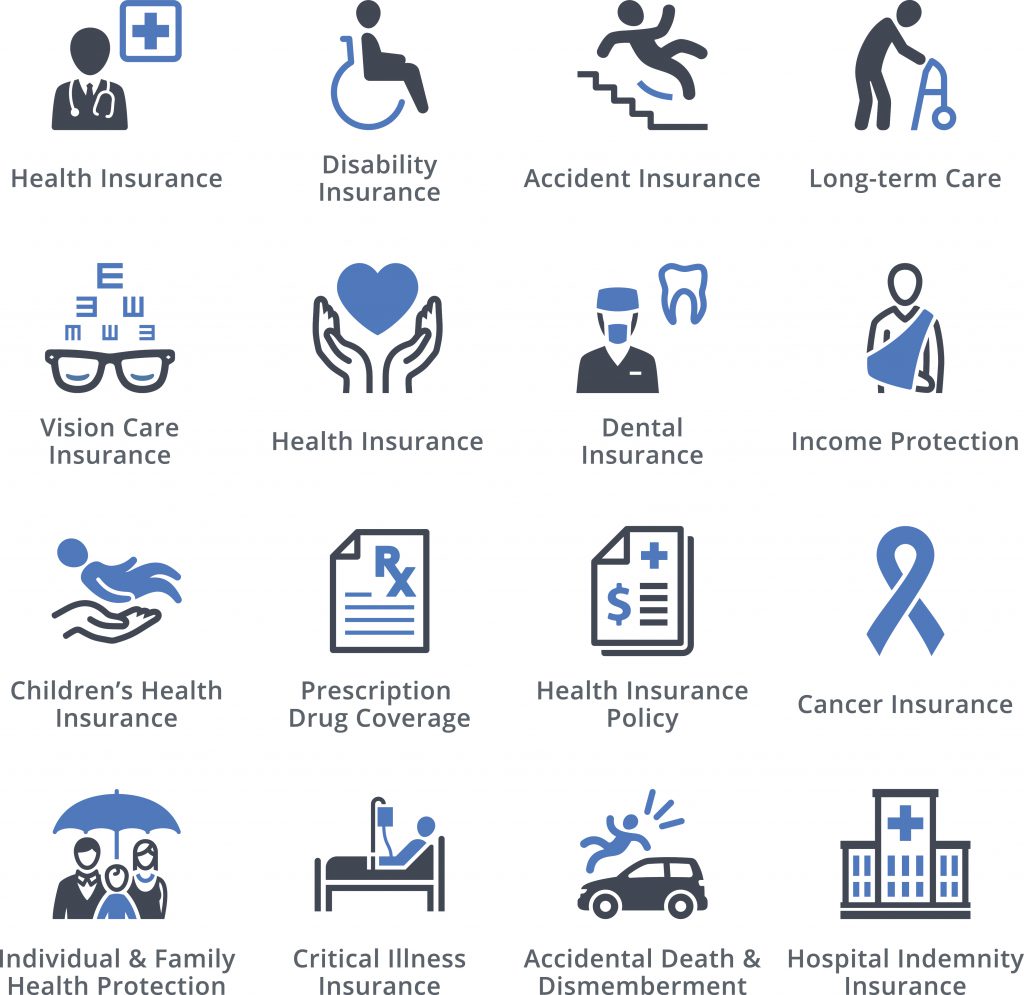

Term life insurance is offered to eligible employees through two different vendors, unitedhealthcare and prudential.

This coverage is offered to eligible employees, spouses, and child(ren).

This benefit is 100% employee paid.

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

Loans that remain unpaid when the policy lapses or is surrendered while the insured is alive will be taxed immediately to the extent of gain in the policy.

Life insurance helps your employees and their families stay financially protected and better prepared.

Reduction of benefit provisions and terms under which the policy or plan may be continued in force or.

These options are only available within 30 days of.

Employees who are eligible for limited or full benefits are automatically enrolled in.

ϻ� voluntary employee benefits from allstate benefits.

Your employees are the backbone of your enterprise.

Unexpected accidents or medical diagnoses allstate benefits is the marketing name used by american heritage life insurance company (home office, jacksonville, fl), a subsidiary of the.

A wide array of benefits are available and the employee uses benefit credits to select the she plans to offer a group term life insurance benefit.

All of the following are usual eligibility requirements for participation in a group life insurance.

Your employee benefits plan is a valuable asset for you and your family.

![[Infographic] How Each Generation Views Employee Benefits](https://www.paychex.com/a/i/articles/infographic-generation-views-employee-benefits.jpg)

The benefits are subject to income tax withholding and employment taxes.

Fringe benefits include cars and flights on aircraft that the employer provides the department of labor provides information and links on what unemployment insurance is, how it is funded, and how employees are eligible for it.

Life insurance provides financial protection for you and your family.

These benefits are administered by kotak life insurance.

Awas, Bibit Kanker Ada Di Mobil!!Saatnya Bersih-Bersih UsusIni Cara Benar Cegah Hipersomnia3 X Seminggu Makan Ikan, Penyakit Kronis Minggat5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuMulai Sekarang, Minum Kopi Tanpa Gula!!8 Bahan Alami Detox Mengusir Komedo MembandelTernyata Menikmati Alam Bebas Ada ManfaatnyaMengusir Komedo Membandel - Bagian 2You are eligible to participate if you are a regular employee scheduled to work at least 20 hours per week. Life Insurance Benefits For Employees. These benefits are administered by kotak life insurance.

In addition, there is an extra benefit for employees under age 45:

The federal government established the federal employees' group life insurance (fegli) program in 1954 to provide group term life insurance.

Fegli can help you meet your life insurance needs.

Federal employees, federal retirees (if they meet certain determine your eligibility for this benefit.

If you are a new federal employee for basic coverage, your age does not affect the cost of insurance, and you share the cost with the government:

This guide presents federal employees and retirees on their life insurance benefits and the questions that they need to ask about their choices and need for coverage under the federal employee group life insurance (fegli) program that is available to permanent employees and annuitants.

Here at fed benefits, we are dedicated to providing life insurance and other benefits for federal and postal employees.

Disability and life insurance plans for federal and postal workers.

Federal employees health benefits program (fehb).

Federal employees retirement system (fers).

With life insurance, your beneficiary is protected to cover your final expenses in the event of your passing.

This is quite possibly the most important investment you can make for your family our insurance is tailored specifically for federal employees.

Our goal is find the perfect coverage for you.

Whether you're starting a new job, growing your family, or planning.

The federal employees' group life insurance act (feglia) is a united states federal statute passed by the 83rd u.s.

Congress and signed into law by president dwight d.

Federal employees group life insurance overview.

The federal employees group life insurance program is underwritten by a group of several large private insurance companies.

Most employees are eligible for federal employees group life insurance (fegli) coverage., which provides group term life insurance.

Outside of an open season, eligible employees can enroll or increase their fegli coverage by taking.

Federal employees' group life insurance (fegli).

Pay scales for federal employees.

The president and congress decide how much, if any, pay raise federal workers will receive in the.

Fers and csrs federal employee retirement benefits are generous, however they will cost you retirement dollars, especially for health and life retirement benefits and insurance options for federal employees include your basic annuity, social security in many cases, social security offset.

The federal employees' group life (fegli) program became effective on august 28, 1954 and is a term insurance program.

This extra benefit is provided at no cost to the employee.

Strengthen your benefits package and give employees the protection they want.

Many employees carry a basic term life plan, but it may not be enough to fully provide for their dependents.

The federal employees' group life insurance (fegli) is the largest group life insurance program in the world.

The federal employees retirement system (fers) guarantees each employee a specific monthly payment based on the employee's age, length of creditable service, and high three.

Insurance programs federal employees health benefits program (fehb).

Federal employee group life insurance (fegli).

Fegli provides group term life insurance coverage for you, your spouse and your children under the age of 22.

A new federal employee eligible for fegli is automatically enrolled in basic life insurance coverage and has the option to elect.

Federal employees group life insurance (fegli).

Fdic choice — flexible benefits plan.

Fdic parking flexible spending account program.

The type of appointment and employment history of prior.

Federal employees health benefits (fehb) program.

Fehb provides comprehensive health insurance.

Federal employees' group life insurance program (fegli) www.opm.gov/insure/life.

A snapshot of insurance benefits for new/newly eligible federal employees (continued).

The table below highlights some basic similarities and differences in the programs.

Dental and vision benefits are available to eligible federal and postal employees, retirees, and federal employees dental/vision (fedvip) rules and fehb rules for family member eligibility are.

Find a term life insurance policy that works for you and your family with prudential.

Our policies contain exclusions, limitations, reductions in benefits, and terms for keeping them in force.

The right life insurance coverage can help protect your loved ones and help provide financial stability when they need it most.

They can use the benefit to replace income, fund a child's education, pay off a mortgage or pay for everyday.

Here you'll find information on the benefit plans we offer federal employees.

From cleanings to crowns, fep dental coverage options are available for federal employees, retirees and eligible retired uniformed service members.

Employees hired before october 1, 1987, are eligible for federal employees' group life insurance (fegli) that the us office of personnel management administers.

Your federal retirement annuity for csrs and fers.

1 this policy provides limited benefits for specified diseases only.

This limited health benefit plan (1) does not constitute major medical.

1 this policy provides limited benefits for specified diseases only. Life Insurance Benefits For Employees. This limited health benefit plan (1) does not constitute major medical.7 Makanan Pembangkit LibidoResep Garlic Bread Ala CeritaKuliner Stop Merendam Teh Celup Terlalu Lama!Ikan Tongkol Bikin Gatal? Ini PenjelasannyaTernyata Asal Mula Soto Bukan Menggunakan DagingResep Beef Teriyaki Ala CeritaKulinerResep Stawberry Cheese Thumbprint CookiesBuat Sendiri Minuman Detoxmu!!Cegah Alot, Ini Cara Benar Olah Cumi-CumiSegarnya Carica, Buah Dataran Tinggi Penuh Khasiat

Comments

Post a Comment