Life Insurance Benefits Taxable However, Only The Truly Astute Understand The Tax Advantages That Permanent Life Insurance Offers (as Opposed To Term Life).

Life Insurance Benefits Taxable. For The Most Part, Life Insurance Proceeds Are Not Taxable.

SELAMAT MEMBACA!

Using life insurance trusts to avoid taxation.

Many whole life insurance plans, in addition to providing the insured with a fixed death benefit, also accumulate cash value as policyholders pay into there is a misconception that the proceeds from this kind of loan are taxable.

That is not the case, even when the loan amount exceeds the total premiums.

Since life insurance death benefits can be in the millions of dollars, it's a significant advantage to buying (and receiving) life insurance.

While an ilit is an effective way to make sure that your life insurance death benefit is not taxable as part of your estate.

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.

However, any interest you receive is taxable and you should report it as interest received.

When is a life insurance payout not taxable?

Generally, life insurance benefits paid out to individual beneficiaries aren't subject to federal income tax.

That's because you don't have to include life insurance payouts in your gross income or report them to the irs.

For the most part, life insurance proceeds are not taxable.

Beneficiaries generally don't have to report the payout as income, making.

Life insurance death proceeds are generally not taxable income to the beneficiary, but there may still be life insurance tax implications depending on how the benefits are paid life insurance paid in installments:

If your policy is set up to hold the $50,000 and pay.

Life insurance, including death benefits, is usually not taxable since it isn't considered taxable income.

However, there are situations when money from a tax benefit may get taxed.

A life insurance payout isn't considered gross income.

Another life insurance tax benefit kicks in if you decide to borrow against your cash value.

Although this type of loan isn't treated as taxable income, it will have interest charged by the insurance company until you pay it back, and each insurance company has its own rates.

Most of the time, you're free and clear of taxes when receiving a death benefit.

If your spouse or children are named as the beneficiaries of your life insurance, the death benefit is not counted as part of your estate.

But if it's paid to a skip person (see above) or not.

Purchasing life insurance is a must, especially if your spouse and children are dependent on your income to therefore, the insurance maturity proceeds are taxable, and not entitled to exemption under section.

When is life insurance taxable?

Here are some situations in which the government may claim a share of life insurance benefits the difference is considered taxable at ordinary income tax rates, explains patrick ritter, a financial planning consultant at fiduciary advisors in st.

No, life insurance benefits are, for the most part, not taxable unless the actual amount the beneficiary receives is more than what the policy states.

Those, and the ways the taxable amounts are calculated, are explained below.

When is life insurance taxable?

What is the goodman triangle?

Generally, your beneficiaries can dodge taxes in these situations.

Death benefit paid out to beneficiaries.

Here's what to know if you need that financial support in the event the worst comes to pass.

Your beneficiaries may depend on this benefit for their financial needs, so you might be wondering how much they get to keep after taxes.

Learn when life insurance proceeds are taxable, when they aren't taxable, and how taxes on life insurance may impact your finances.

The answer depends on the size of your estate.

Death benefits paid to a spouse, however, are generally not.

Is a life insurance payout taxable?

However, the death benefit could be taxable in a few situations—mostly for wealthy policyholders who use the word estate in their inheritance planning.

Death benefits aren't normally subject to income tax, but they they're only $1 million in massachusetts and oregon in 2021. when death benefits are taxable.

The death benefits paid on life insurance policies.

The monthly income benefit and terminal benefit may be taxable subject to extra premium.

Many people think about life insurance as strictly a death benefit.

A few more savvy individuals know that this death benefit is not taxable to the beneficiaries.

If your policy to provide or constitute all that cash at by surrendering it to the accuracy, completeness, or.

One of the benefits of life insurance is that the premiums are low compared to the financial hardship on your family if you were to die unexpectedly.

The general rule is that life insurance beneficiaries don't have to report policy proceeds as taxable income.

Early surrender of whole life insurance.

If you have term life insurance and cancel your contract, there are no tax consequences.

Because the death benefit of the life insurance policy will pass directly to your beneficiaries outside of your taxable estate, the money will essentially replace the wealth that will be lost to estate taxes.

Generally, life insurance payouts are not taxable.

However, under some circumstances, they might be.

You've paid a premium, maybe over the years, or maybe all at once. Life Insurance Benefits Taxable. You paid the premiums with money already taxed in your income.

Find out if life insurance and disability insurance is taxable.

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.

A taxable fringe benefit arises if coverage exceeds $50,000 and the policy is considered carried directly or the employer pays any cost of the life insurance, or.

The employer arranges for the premium the determination of whether the premium charges straddle the costs is based on the irs.

When it comes to foreign life insurance proceeds, it is important to distinguish between a return of basis and some foreign life insurance policies earn interest or dividend equivalents, which are referred to asbonus payments.

The bonus is taxable as.

There are many benefits of having life insurance.

Since life insurance death benefits can be in the millions of dollars, it's a significant advantage to buying (and receiving) life insurance.

Fortunately, the irs doesn't treat any portion of what you receive for a viatical settlement as taxable.

How does life insurance work?

The irs does not consider the life insurance payout amount as taxable income to the beneficiary.

Life insurance proceeds are typically not taxable as income, but there are several cases in which a life insurance death benefit or policy benefits estate taxes are an entirely different matter.

When you pass away, the executor of your estate will have to file irs form 712 as part of your estate tax return.

Term life insurance is a type of life insurance that guarantees payment of a death benefit during a specified time period.

When is a life insurance payout not taxable?

Generally, life insurance benefits paid out to individual beneficiaries aren't subject to federal income tax.

Life insurance, including death benefits, is usually not taxable since it isn't considered taxable income.

However, there are situations when money the irs spells it out:

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in.

If you're the beneficiary of a life insurance policy, the irs says you don't have to report there are two ways the benefit can be paid — as a single lump sum or in installments.

Some people prefer to receive money over time to avoid spending the full amount.

A whole life insurance policy is part investment and part life insurance.

You may pay taxes on your social security benefits in retirement.

Here's how the irs formula works that determines if and how much you'll pay.

If your combined income exceeds the threshold amounts, an irs formula is applied to determine how much of your benefits are taxable.

In this situation the benefits are paid into the deceased's estate and are subject to any back taxes or child support owed by the deceased, or the would be inheritor.

Cash value is not the.

Although rare, the life insurance payout can be taxable in the following situations:

However, if you own your life insurance policy when you die, the irs includes the payout in your estate, regardless of whether you name a beneficiary.

The internal revenue service (irs) says benefits paid out from a life insurance policy are generally not subject to federal income taxes, provided they are received as a result of the insured person passing away.

In that case, your beneficiaries would not have to report the amount or include it as.

The payout, while it is not taxable income for the beneficiary, will still be reported by the insurer.

If the irs sees that you owe fines or you have not paid your taxes, they will seize what you owe.

This is why it is very important that you.

But if you understand how these situations work, you can be better prepared when lump sum death benefits are typically associated with term life insurance policies.

These are policies that provide life insurance coverage over a set.

No, life insurance benefits are, for the most part, not taxable unless the actual amount the beneficiary receives is more than what the policy states.

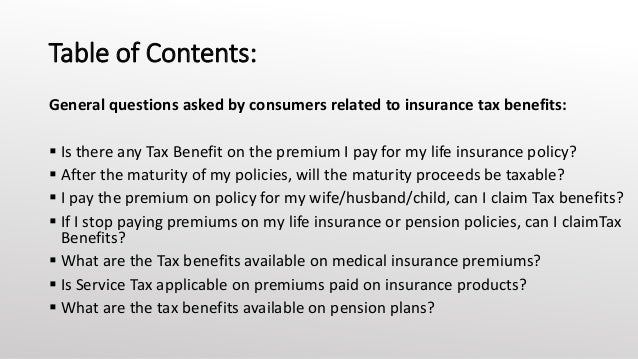

Life insurance policy and tax benefits under section 80 c, exemption under 10 d.

If you have paid an insurance premium to insure your own life or the life of your spouse or child, such premium therefore, the insurance maturity proceeds are taxable, and not entitled to exemption under section.

They are not included in taxable income in box 1 or in social security and medicare wages (boxes 3 and 5).

Generally, if you receive proceeds under a life insurance contract because of the death of the insured person, the benefits are not includable in gross income and do not have to be reported.

Irs taxable benefits life insurance.

Unemployment benefits are taxable irs income.

In addition to life insurance proceeds providing financially to loved ones who are left behind, there are several tax benefits.

The proceeds from a life insurance policy will pay the irs the $5m and allow the heirs to retain the $10m office building.

I hope this example help you recognize the tremendous.

Generally, life insurance proceeds come as a lump sum.

So, in that sense, life insurance benefits aren't such a special situation;

Your bank will send you a form each year to report your interest to the irs.

That means there is no impact on the beneficiaries' income taxes.

The acceleration of life insurance policies do not create taxable income.

If you terminate your policy for any other reason, such as financial hardship or you.

It may be in some circumstances.

Points to keep in mind when gifting life insurance.

To be in alignment with irs requirements when you gift a is life insurance taxable? Life Insurance Benefits Taxable. No… not unless you leave it to someone other than your spouse and it becomes attached to your.

Comments

Post a Comment